Form Ct-1120x - Amended Corporation Business Tax Return - 2007

ADVERTISEMENT

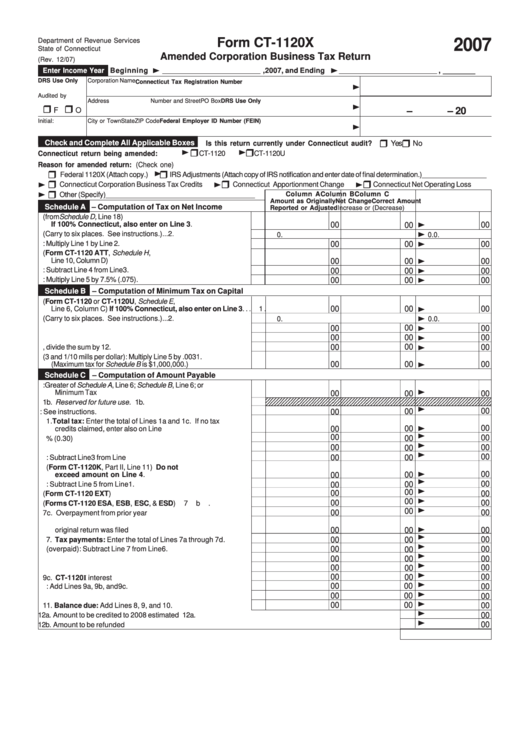

Form CT-1120X

2007

Department of Revenue Services

State of Connecticut

Amended Corporation Business Tax Return

(Rev. 12/07)

Enter Income Year

Beginning

, 2007, and Ending

, ________

____________________

____________________

DRS Use Only

Corporation Name

Connecticut Tax Registration Number

Audited by

Address

Number and Street

PO Box

DRS Use Only

–

– 20

F

O

Initial:

City or Town

State

ZIP Code

Federal Employer ID Number (FEIN)

Check and Complete All Applicable Boxes

Yes

No

Is this return currently under Connecticut audit?

Connecticut return being amended:

CT-1120

CT-1120U

Reason for amended return: (Check one)

Federal 1120X (Attach copy.)

IRS Adjustments (Attach copy of IRS notification and enter date of final determination.) ________________

Connecticut Corporation Business Tax Credits

Connecticut Apportionment Change

Connecticut Net Operating Loss

Other (Specify) _____________________________________

Column A

Column B

Column C

Amount as Originally

Net Change

Correct Amount

Schedule A

– Computation of Tax on Net Income

Reported or Adjusted

Increase or (Decrease)

1. Net income (from Schedule D, Line 18)

If 100% Connecticut, also enter on Line 3. ............................

1.

00

00

00

2. Apportionment fraction (Carry to six places. See instructions.) ...

2.

0.

0.

0.

3. Connecticut net income: Multiply Line 1 by Line 2. ........................

3.

00

00

00

4. Operating loss carryover (Form CT-1120 ATT, Schedule H,

Line 10, Column D) .......................................................................

4.

00

00

00

5. Income subject to tax: Subtract Line 4 from Line 3. ......................

5.

00

00

00

6. Tax: Multiply Line 5 by 7.5% (.075). .............................................

6.

00

00

00

Schedule B

– Computation of Minimum Tax on Capital

1. Minimum tax base (Form CT-1120 or CT-1120U, Schedule E,

00

00

00

Line 6, Column C) If 100% Connecticut, also enter on Line 3. ..

1.

2. Apportionment fraction (Carry to six places. See instructions.) ...

2.

0.

0.

0.

00

00

00

3. Multiply Line 1 by Line 2. ..............................................................

3.

00

00

00

4. Number of months covered by this return ....................................

4.

00

00

00

5. Multiply Line 3 by Line 4, divide the sum by 12. .............................

5.

6. Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031.

00

00

00

(Maximum tax for Schedule B is $1,000,000.) ..............................

6.

Schedule C

– Computation of Amount Payable

1a. Tax: Greater of Schedule A, Line 6; Schedule B, Line 6; or

Minimum Tax ............................................................................. 1a.

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1b. Reserved for future use. .......................................................... 1b.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

00

00

00

1c. Recapture of tax credits: See instructions. .............................. 1c.

1. Total tax: Enter the total of Lines 1a and 1c. If no tax

00

00

00

credits claimed, enter also on Line 6. .......................................

1.

00

00

00

2. Multiply Line 1 by 30% (0.30). ..................................................

2.

00

00

00

3. Enter the greater of Line 2 or Minimum Tax. .............................

3.

00

00

00

4. Tax credit limitation: Subtract Line 3 from Line 1. .....................

4.

5. Tax credits (Form CT-1120K, Part II, Line 11) Do not

00

00

00

exceed amount on Line 4. ...................................................

5.

00

00

6. Balance of tax payable: Subtract Line 5 from Line 1. ...............

6.

00

00

00

00

7a. Paid with application for extension (Form CT-1120 EXT) ....... 7a.

00

00

00

7b. Paid with estimates (Forms CT-1120 ESA, ESB, ESC, & ESD)

7b.

00

00

00

7c. Overpayment from prior year .................................................. 7c.

7d. Amount paid with original return plus additional tax paid after

00

original return was filed ........................................................... 7d.

00

00

00

00

00

7. Tax payments: Enter the total of Lines 7a through 7d. ...........

7.

00

00

00

8. Balance of tax due (overpaid): Subtract Line 7 from Line 6. ....

8.

00

00

00

9a. Penalty ..................................................................................... 9a.

00

00

00

9b. Interest ..................................................................................... 9b.

00

00

00

9c. CT-1120I interest .................................................................... 9c.

00

00

00

9. Penalty and interest: Add Lines 9a, 9b, and 9c. .......................

9.

00

00

00

10. Overpayment originally credited to 2007 estimated tax or refunded 10.

00

00

00

11. Balance due: Add Lines 8, 9, and 10. .....................................

11.

00

12a. Amount to be credited to 2008 estimated tax ......................................................................................................... 12a.

00

12b. Amount to be refunded ......................................................................................................................................... 12b.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2