Form Op-300 - Schedule C - Tobacco Products Tax - Record Of Tobacco Products, Excluding Snuff Tobacco Products, Exported Out Of Connecticut

ADVERTISEMENT

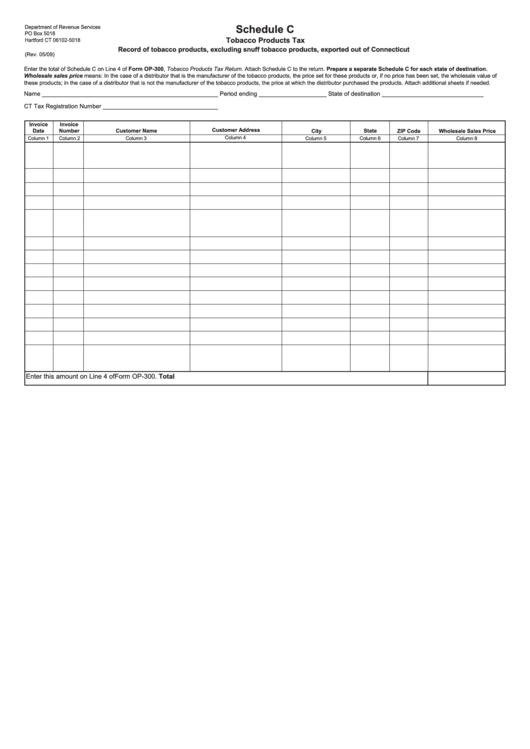

Schedule C

Department of Revenue Services

PO Box 5018

Tobacco Products Tax

Hartford CT 06102-5018

Record of tobacco products, excluding snuff tobacco products, exported out of Connecticut

(Rev. 05/09)

Enter the total of Schedule C on Line 4 of Form OP-300, Tobacco Products Tax Return. Attach Schedule C to the return. Prepare a separate Schedule C for each state of destination.

Wholesale sales price means: In the case of a distributor that is the manufacturer of the tobacco products, the price set for these products or, if no price has been set, the wholesale value of

these products; in the case of a distributor that is not the manufacturer of the tobacco products, the price at which the distributor purchased the products. Attach additional sheets if needed.

Name ____________________________________________________

Period ending ____________________

State of destination ______________________________

CT Tax Registration Number __________________________________

Invoice

Invoice

Customer Address

Date

Number

Customer Name

City

State

ZIP Code

Wholesale Sales Price

Column 4

Column 3

Column 1

Column 2

Column 5

Column 6

Column 7

Column 8

Enter this amount on Line 4 of Form OP-300.

Total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1