Form Ss-6042 - Exemption Request - State Of Tennessee

ADVERTISEMENT

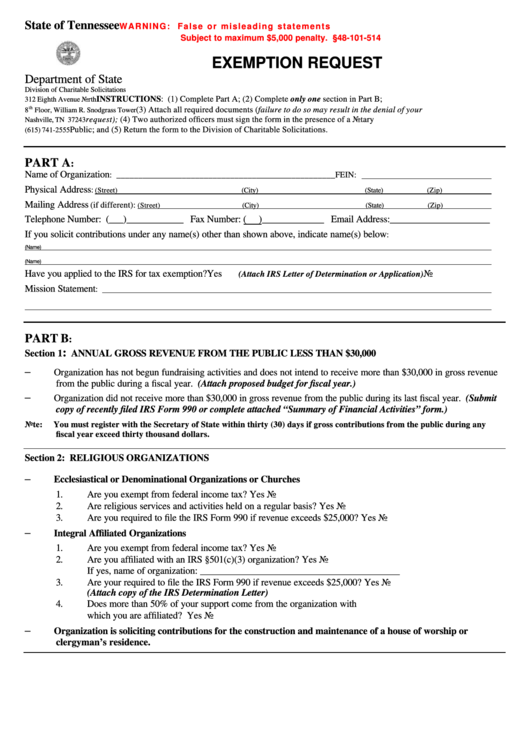

State of Tennessee

W A R N I N G : F a l s e o r m i s l e a d i n g s t a t e m e n t s

Subject to maximum $5,000 penalty. T.C.A. §48-101-514

EXEMPTION REQUEST

Department of State

Division of Charitable Solicitations

INSTRUCTIONS: (1) Complete Part A; (2) Complete only one section in Part B;

312 Eighth Avenue North

th

(3) Attach all required documents (failure to do so may result in the denial of your

8

Floor, William R. Snodgrass Tower

request); (4) Two authorized officers must sign the form in the presence of a Notary

Nashville, TN 37243

Public; and (5) Return the form to the Division of Charitable Solicitations.

(615) 741-2555

PART A

:

Name of Organization

: __________________________________________________ FEIN:

Physical Address

:

(Street)

(City)

(State)

(Zip)

Mailing Address

(if different):

(Street)

(City)

(State)

(Zip)

Telephone Number: (___)____________ Fax Number: (

)_____________ Email Address:_____________________

If you solicit contributions under any name(s) other than shown above, indicate name(s) below

:

(Name)

(Name)

Have you applied to the IRS for tax exemption? Yes

No

(Attach IRS Letter of Determination or Application)

Mission Statement

:

PART B

:

:

Section 1

ANNUAL GROSS REVENUE FROM THE PUBLIC LESS THAN $30,000

–

Organization has not begun fundraising activities and does not intend to receive more than $30,000 in gross revenue

from the public during a fiscal year. (Attach proposed budget for fiscal year.)

–

Organization did not receive more than $30,000 in gross revenue from the public during its last fiscal year. (Submit

copy of recently filed IRS Form 990 or complete attached “Summary of Financial Activities” form.)

Note:

You must register with the Secretary of State within thirty (30) days if gross contributions from the public during any

fiscal year exceed thirty thousand dollars.

Section 2: RELIGIOUS ORGANIZATIONS

–

Ecclesiastical or Denominational Organizations or Churches

1.

Are you exempt from federal income tax?

Yes

No

2.

Are religious services and activities held on a regular basis?

Yes

No

3.

Are you required to file the IRS Form 990 if revenue exceeds $25,000?

Yes

No

–

Integral Affiliated Organizations

1.

Are you exempt from federal income tax?

Yes

No

2.

Are you affiliated with an IRS §501(c)(3) organization?

Yes

No

If yes, name of organization: __________________________________________

3.

Are your required to file the IRS Form 990 if revenue exceeds $25,000?

Yes

No

(Attach copy of the IRS Determination Letter)

4.

Does more than 50% of your support come from the organization with

which you are affiliated?

Yes

No

–

Organization is soliciting contributions for the construction and maintenance of a house of worship or

clergyman’s residence.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2