Form Gew-Ta-Rv-6 - Application For Extension Of Time To File The Ge/use Tax

ADVERTISEMENT

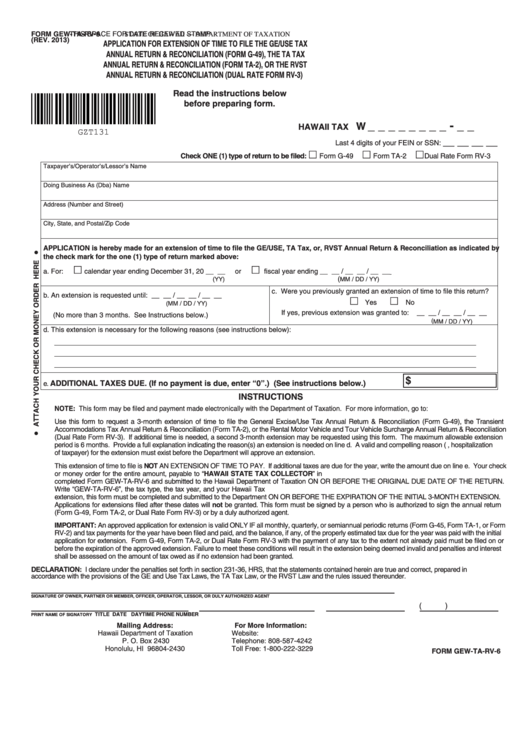

FORM GEW-TA-RV-6

STATE OF HAWAII — DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

(REV. 2013)

APPLICATION FOR EXTENSION OF TIME TO FILE THE GE/USE TAX

ANNUAL RETURN & RECONCILIATION (FORM G-49), THE TA TAX

ANNUAL RETURN & RECONCILIATION (FORM TA-2), OR THE RVST

ANNUAL RETURN & RECONCILIATION (DUAL RATE FORM RV-3)

Read the instructions below

before preparing form.

_ _ _ _ _ _ _ _ - _ _

HAWAII TAX I.D. NO. W

GZT131

__ __ __ __

Last 4 digits of your FEIN or SSN:

Check ONE (1) type of return to be filed:

Form G-49

Form TA-2

Dual Rate Form RV-3

Taxpayer’s/Operator’s/Lessor’s Name

Doing Business As (Dba) Name

Address (Number and Street)

City, State, and Postal/Zip Code

APPLICATION is hereby made for an extension of time to file the GE/USE, TA Tax, or, RVST Annual Return & Reconciliation as indicated by

the check mark for the one (1) type of return marked above:

a. For:

calendar year ending December 31, 20 __ __

or

fiscal year ending __ __ / __ __ / __ __

(

(YY)

MM / DD / YY)

c. Were you previously granted an extension of time to file this return?

b. An extension is requested until: __ __ / __ __ / __ __

Yes

No

(MM / DD / YY)

If yes, previous extension was granted to:

__ __ / __ __ / __ __

(No more than 3 months. See Instructions below.)

( MM / DD / YY)

d. This extension is necessary for the following reasons (see instructions below):

$

ADDITIONAL TAXES DUE. (If no payment is due, enter “0”.) (See instructions below.) ...............

e.

INSTRUCTIONS

NOTE: This form may be filed and payment made electronically with the Department of Taxation. For more information, go to:

Use this form to request a 3-month extension of time to file the General Excise/Use Tax Annual Return & Reconciliation (Form G-49), the Transient

Accommodations Tax Annual Return & Reconciliation (Form TA-2), or the Rental Motor Vehicle and Tour Vehicle Surcharge Annual Return & Reconciliation

(Dual Rate Form RV-3). If additional time is needed, a second 3-month extension may be requested using this form. The maximum allowable extension

period is 6 months. Provide a full explanation indicating the reason(s) an extension is needed on line d. A valid and compelling reason (e.g., hospitalization

of taxpayer) for the extension must exist before the Department will approve an extension.

This extension of time to file is NOT AN EXTENSION OF TIME TO PAY. If additional taxes are due for the year, write the amount due on line e. Your check

or money order for the entire amount, payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. bank must be attached to the

completed Form GEW-TA-RV-6 and submitted to the Hawaii Department of Taxation ON OR BEFORE THE ORIGINAL DUE DATE OF THE RETURN.

Write “GEW-TA-RV-6”, the tax type, the tax year, and your Hawaii Tax I.D. No. on your check or money order. If you are requesting a second 3-month

extension, this form must be completed and submitted to the Department ON OR BEFORE THE EXPIRATION OF THE INITIAL 3-MONTH EXTENSION.

Applications for extensions filed after these dates will not be granted. This form must be signed by a person who is authorized to sign the annual return

(Form G-49, Form TA-2, or Dual Rate Form RV-3) or by a duly authorized agent.

IMPORTANT: An approved application for extension is valid ONLY IF all monthly, quarterly, or semiannual periodic returns (Form G-45, Form TA-1, or Form

RV-2) and tax payments for the year have been filed and paid, and the balance, if any, of the properly estimated tax due for the year was paid with the initial

application for extension. Form G-49, Form TA-2, or Dual Rate Form RV-3 with the payment of any tax to the extent not already paid must be filed on or

before the expiration of the approved extension. Failure to meet these conditions will result in the extension being deemed invalid and penalties and interest

shall be assessed on the amount of tax owed as if no extension had been granted.

DECLARATION: I declare under the penalties set forth in section 231-36, HRS, that the statements contained herein are true and correct, prepared in

accordance with the provisions of the GE and Use Tax Laws, the TA Tax Law, or the RVST Law and the rules issued thereunder.

SIGNATURE OF OWNER, PARTNER OR MEMBER, OFFICER, OPERATOR, LESSOR, OR DULY AUTHORIZED AGENT

(

)

PRINT NAME OF SIGNATORY

TITLE

DATE

DAYTIME PHONE NUMBER

Mailing Address:

For More Information:

Website: tax.hawaii.gov

Hawaii Department of Taxation

Telephone: 808-587-4242

P. O. Box 2430

Honolulu, HI 96804-2430

Toll Free: 1-800-222-3229

FORM GEW-TA-RV-6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1