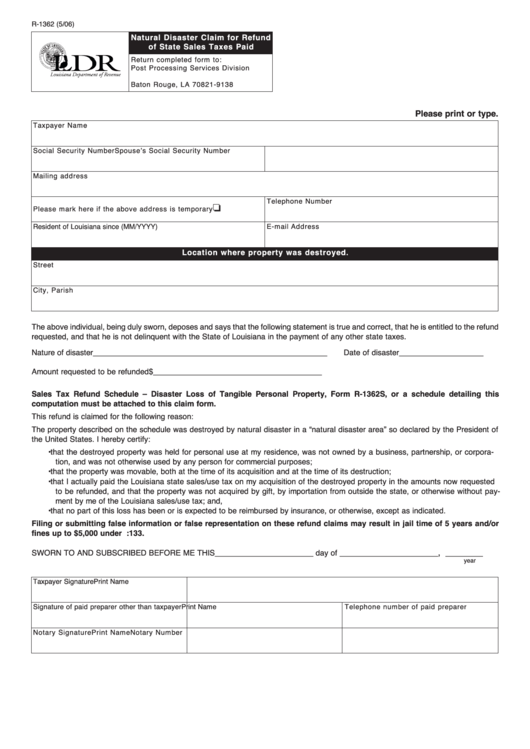

R-1362 (5/06)

Natural Disaster Claim for Refund

of State Sales Taxes Paid

Return completed form to:

Post Processing Services Division

P.O. Box 91138

Baton Rouge, LA 70821-9138

Please print or type.

Taxpayer Name

Social Security Number

Spouse’s Social Security Number

Mailing address

Telephone Number

❏

Please mark here if the above address is temporary

Resident of Louisiana since (MM/YYYY)

E-mail Address

Location where property was destroyed.

Street

City, Parish

The above individual, being duly sworn, deposes and says that the following statement is true and correct, that he is entitled to the refund

requested, and that he is not delinquent with the State of Louisiana in the payment of any other state taxes.

__________________________________________________

__________________

Nature of disaster

Date of disaster

____________________________________

Amount requested to be refunded $

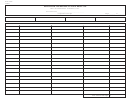

Sales Tax Refund Schedule – Disaster Loss of Tangible Personal Property, Form R-1362S, or a schedule detailing this

computation must be attached to this claim form.

This refund is claimed for the following reason:

The property described on the schedule was destroyed by natural disaster in a “natural disaster area” so declared by the President of

the United States. I hereby certify:

• that the destroyed property was held for personal use at my residence, was not owned by a business, partnership, or corpora-

tion, and was not otherwise used by any person for commercial purposes;

• that the property was movable, both at the time of its acquisition and at the time of its destruction;

• that I actually paid the Louisiana state sales/use tax on my acquisition of the destroyed property in the amounts now requested

to be refunded, and that the property was not acquired by gift, by importation from outside the state, or otherwise without pay-

ment by me of the Louisiana sales/use tax; and,

• that no part of this loss has been or is expected to be reimbursed by insurance, or otherwise, except as indicated.

Filing or submitting false information or false representation on these refund claims may result in jail time of 5 years and/or

fines up to $5,000 under LSA-R.S.14:133.

_____________________

_____________________, ________

SWORN TO AND SUBSCRIBED BEFORE ME THIS

day of

year

Taxpayer Signature

Print Name

Signature of paid preparer other than taxpayer

Print Name

Telephone number of paid preparer

Notary Signature

Print Name

Notary Number

1

1