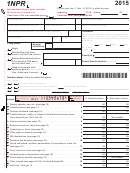

1NPR – Nonresident and part-year resident — 1998

Page 3

Name(s) as shown on Form 1NPR

Your social security number

Schedule 1 – Tax Computation

1. If your filing status is:

• Single or head of household, fill in $7,500

• Married filing joint return, fill in $10,000

.

• Married filing separate return, fill in $5,000 ................................................................ 1. _______________

x .

2. Fill in the ratio from Form 1NPR, line 30 ....................................................................... 2. _______________

3. Multiply line 1 by line 2 ................................................................................................... 3. _______________

.

.

4. Fill in the amount from Form 1NPR, line 34 .................................................................. 4. _______________

.

5. Fill in the smaller of line 3 or line 4 ................................................................................ 5. _______________

.

6. Multiply line 5 by 4.77% (.0477). Round the result to the nearest cent .................................................... 6. _______________

7. Subtract line 5 from line 4. If the result is zero, skip lines 8 through 11 and go to line 12 . 7. _______________

.

8. Fill in the smaller of line 3 or line 7 ................................................................................ 8. _______________

.

.

9. Multiply line 8 by 6.37% (.0637). Round the result to the nearest cent ........................................................ 9. _______________

.

10. Subtract line 8 from line 7. If the result is zero, skip line 11 and go to line 12 ........... 10. _______________

.

11. Multiply line 10 by 6.77% (.0677). Round the result to the nearest cent........................................................ 11. _______________

.

12. Add lines 6, 9, and 11. Fill in the total here and on Form 1NPR, line 35 ...................................................... 12. _______________

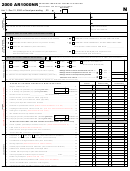

Schedule 2 – Wisconsin Itemized Deduction Credit

(see line 38 instructions)

1 Medical and dental expenses from line 4, federal Schedule A. See instructions for exceptions ............ 1

.

2 Interest paid from line 14, federal Schedule A. Do not include interest paid on a second home

located outside Wisconsin or on a residence which is a boat. Also, do not include interest paid to

.

purchase or hold U.S. government securities .......................................................................................... 2

.

3 Gifts to charity from line 18, federal Schedule A. See instructions for exceptions ................................. 3

4 Job expenses and miscellaneous deductions from line 26, federal Schedule A. See instructions

.

for exceptions ............................................................................................................................................ 4

.

5 Other miscellaneous deductions from line 27, federal Schedule A. See instructions for exceptions .... 5

.

6 Add lines 1 through 5 ................................................................................................................................ 6

.

7 Wisconsin standard deduction from Form 1NPR, line 33e ...................................................................... 7

.

8 Subtract line 7 from line 6. If line 7 is more than line 6, fill in -0- ............................................................. 8

9 Rate of credit is .05 (5%) .......................................................................................................................... 9

X .05

.

10 Multiply line 8 by line 9. Fill in here and on line 38 of Form 1NPR .......................................................... 10

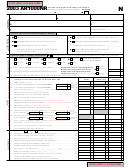

Schedule 3 – Married Couple Credit

(May be claimed only when both spouses have earned income taxable by

Wisconsin.) When completing this schedule, be sure to fill in your Wisconsin income in column (A) and your spouse’s Wisconsin

income in column (B).

(A) YOURSELF

(B) YOUR SPOUSE

.

.

1 Wages, salaries, tips, etc., included in column B of line 1 on Form 1NPR .......

1

2 Net profit or loss from self-employment from federal Schedules C, C-EZ, and F

(Form 1040), Schedule K-1 (Form 1065), and any other taxable self-employment

.

.

or earned income, which is included in column B on Form 1NPR ......................

2

.

.

3 Combine lines 1 and 2. This is your total Wisconsin earned income ................

3

4 Add amounts on Form 1NPR, lines 17, 23, and 26, column B. Fill in the

.

.

total of these adjustments that apply to your or your spouse’s income .............

4

.

.

5 Subtract line 4 from line 3. This is your Wisconsin qualified earned income ....

5

6 Compare the amount in columns (A) and (B) of line 5. Fill in the smaller

.

amount here. If more than $14,010, fill in $14,010 ................................................................

6

X .0217

7 Rate of credit is .0217 (2.17%) ................................................................................................

7

.

8 Multiply line 6 by line 7. Fill in here and on line 46 of Form 1NPR. Do not fill in more than $304

8

1

1 2

2 3

3 4

4