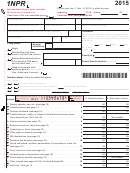

Page 2

Tax Computation

.

31

Fill in Wisconsin income from line 28, column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

.

32

Fill in federal income from line 29, column A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

33a Aliens (see page 18 to determine if you must check this box) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33a

33b If you can be claimed as a dependent on anyone else’s return, check this box

(also see “Exception” in instructions for line 33e on page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33b

.

33c Find the standard deduction for amount on line 32 using table on page 30 . . . . . . 33c

.

33d Fill in ratio from line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33d

X

.

33e Multiply line 33c by ratio on line 33d. This is your Wisconsin standard deduction . . . . . . . . . . . . . . . . . . . . . . . . . 33e

.

34

Subtract line 33e from line 31. This is your Wisconsin net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

.

35

Tax. Compute tax using Schedule 1 (page 3 of Form 1NPR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

36

Dependent credit (don’t count yourself or your spouse)

.

Fill in number of dependents . . . . . . . . . . . . . . . . . . . . . . .

x $50 = 36

.

37

Senior citizen credit (Caution: see page 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

.

38

Wisconsin itemized deduction credit. Attach Schedule 2 (page 3 of Form 1NPR) . 38

39

School property tax credit (Part-year and full-year Wisconsin residents only)

a. Renters:

Rent paid in 1998–heat included

Find credit from

table, page 21 . . . . .

.

Rent paid in 1998–heat not included

39a

b. Home owners:

Find credit from

.

Property taxes paid on home in 1998

table, page 22 . . . . .

39b

.

40a Add lines 36 through 39b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40a

X

.

40b Fill in ratio from line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40b

.

40c Multiply line 40a by ratio on line 40b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40c

.

41

Working families tax credit (Full-year Wisconsin residents only) . . . . . . . . . . . . . . 41

.

42

Add lines 40c and 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

.

43

Subtract line 42 from line 35. If line 42 is more than line 35, fill in -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

.

44

Alternative minimum tax. Attach Schedule MT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

.

45

Add lines 43 and 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

.

46

Married couple credit. Attach Schedule 3 (page 3 of Form 1NPR) . . . . . . . . . . . . . 46

.

47

Manufacturer's sales tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

.

48

Add lines 46 and 47 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

.

49

Subtract line 48 from line 45. If line 48 is more than line 45, fill in -0-. This is your net tax . . . . . . . . . . . . . . . . . . 49

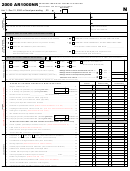

50

Temporary recycling surcharge (see instructions, page 23)

Check if surcharge computed on worksheet

.

If worksheet not used, fill in nonfarm net business income . . . . . . . . . . . . .

x .002173 = 50

.

51

Sales and use tax due on out-of-state purchases (see instructions, page 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

.

52

Endangered resources donation (decreases refund or increases amount owed)

. . . . . . . . . . . . . . . . .

52

.

.

53

Penalties on IRAs, other retirement plans, MSAs, etc. (see instructions, page 25) . .

x .33 = 53

.

54

Add lines 49 through 53 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Payments and Credits

.

55

Wisconsin income tax withheld. Attach readable withholding statements . . . . . . . 55

.

56

1998 Wisconsin estimated tax payments and amount applied from 1997 return . . 56

57

Earned income credit. (Full-year Wisconsin residents only)

.

Number of qualifying children

Federal credit

x

% = 57

58

Farmland preservation credit. Attach Schedule FC (Full-year Wisconsin

.

residents only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

.

59

Net income tax paid to another state on income earned while a Wisconsin resident 59

.

60

Homestead credit. Attach Schedule H (Full-year Wisconsin residents only) . . . . . 60

61

Farmland tax relief credit (Full-year Wisconsin residents only)

.

.

Fill in property taxes on farmland . . . . . . . . . . . . . . .

x .10 = 61

.

62

Add lines 55 through 61 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

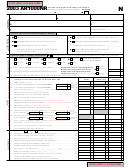

Refund or Amount You Owe

.

63

If line 62 is more than line 54, subtract line 54 from line 62 . . . . . . . . . This is the AMOUNT YOU OVERPAID

63

.

64

Amount of line 63 you want REFUNDED TO YOU . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

64

.

65

Amount of line 63 to be APPLIED TO YOUR 1999 ESTIMATED TAX . . . . . . . . . 65

.

66

If line 62 is less than line 54, subtract line 62 from line 54 . . . . . . . . . . . . . . . This is the AMOUNT YOU OWE

66

Attach a copy of your federal income tax return and schedules to this return

(Also attach a completed Legal Residence Questionnaire, if required. See page 6 of instructions.)

Sign here

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Your signature

Spouse’s signature (if filing jointly, BOTH must sign)

Date

For Department Use Only

Mail your return to:

Wisconsin Department of Revenue

R

M

Y

T

MAN

D

A

P

C

(if tax is due)

(if refund or no tax due)

P.O. Box 268

P.O. Box 59

Madison, WI 53790-0001

Madison, WI 53785-0001

1

1 2

2 3

3 4

4