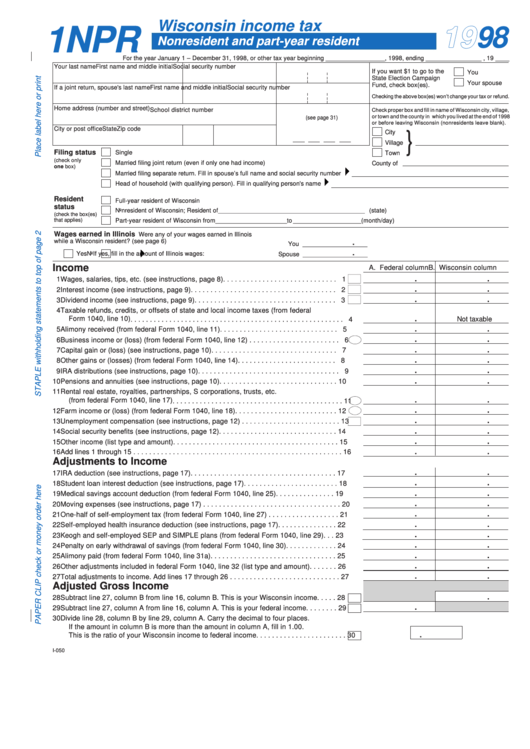

Wisconsin income tax

1NPR

1998

Nonresident and part-year resident

For the year January 1 – December 31, 1998, or other tax year beginning _________________, 1998, ending ________________ , 19 ____

Your last name

First name and middle initial

Social security number

If you want $1 to go to the

You

State Election Campaign

Your spouse

Fund, check box(es).

If a joint return, spouse's last name

First name and middle initial

Social security number

Checking the above box(es) won’t change your tax or refund.

Home address (number and street)

School district number

Check proper box and fill in name of Wisconsin city, village,

or town and the county in which you lived at the end of 1998

(see page 31)

or before leaving Wisconsin (nonresidents leave blank).

City or post office

State

Zip code

City

}

Village

Filing status

Single

Town

(check only

Married filing joint return (even if only one had income)

County of

one box)

Married filing separate return. Fill in spouse’s full name and social security number

Head of household (with qualifying person). Fill in qualifying person's name

Resident

Full-year resident of Wisconsin

status

Nonresident of Wisconsin; Resident of ___________________________________________ (state)

(check the box(es)

that applies)

Part-year resident of Wisconsin from _____________________ to ____________________ (month/day)

Wages earned in Illinois

Were any of your wages earned in Illinois

while a Wisconsin resident? (see page 6)

.

You ___________________

.

Yes

No

If yes, fill in the amount of Illinois wages:

Spouse ___________________

Income

A. Federal column

B. Wisconsin column

.

.

01

Wages, salaries, tips, etc. (see instructions, page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

01

.

.

02

Interest income (see instructions, page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

02

.

.

03

Dividend income (see instructions, page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

03

04

Taxable refunds, credits, or offsets of state and local income taxes (from federal

.

Form 1040, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

04

Not taxable

.

.

05

Alimony received (from federal Form 1040, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

05

.

.

06

Business income or (loss) (from federal Form 1040, line 12) . . . . . . . . . . . . . . . . . . . . . . .

06

.

.

07

Capital gain or (loss) (see instructions, page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

07

.

.

08

Other gains or (losses) (from federal Form 1040, line 14) . . . . . . . . . . . . . . . . . . . . . . . . .

08

.

.

9

IRA distributions (see instructions, page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.

.

10

Pensions and annuities (see instructions, page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Rental real estate, royalties, partnerships, S corporations, trusts, etc.

.

.

(from federal Form 1040, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

.

.

12

Farm income or (loss) (from federal Form 1040, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . .

12

.

.

13

Unemployment compensation (see instructions, page 12) . . . . . . . . . . . . . . . . . . . . . . . . .

13

.

.

14

Social security benefits (see instructions, page 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

.

.

15

Other income (list type and amount) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

.

.

16

Add lines 1 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Adjustments to Income

.

.

17

IRA deduction (see instructions, page 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

.

.

18

Student loan interest deduction (see instructions, page 17) . . . . . . . . . . . . . . . . . . . . . . . .

18

.

.

19

Medical savings account deduction (from federal Form 1040, line 25) . . . . . . . . . . . . . . .

19

.

.

20

Moving expenses (see instructions, page 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

.

.

21

One-half of self-employment tax (from federal Form 1040, line 27) . . . . . . . . . . . . . . . . . .

21

.

.

22

Self-employed health insurance deduction (see instructions, page 17) . . . . . . . . . . . . . . .

22

.

.

23

Keogh and self-employed SEP and SIMPLE plans (from federal Form 1040, line 29) . . .

23

.

.

24

Penalty on early withdrawal of savings (from federal Form 1040, line 30) . . . . . . . . . . . . .

24

.

.

25

Alimony paid (from federal Form 1040, line 31a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

.

.

26

Other adjustments included in federal Form 1040, line 32 (list type and amount) . . . . . . .

26

.

.

27

Total adjustments to income. Add lines 17 through 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Adjusted Gross Income

.

28

Subtract line 27, column B from line 16, column B. This is your Wisconsin income . . . . .

28

.

29

Subtract line 27, column A from line 16, column A. This is your federal income . . . . . . . .

29

30

Divide line 28, column B by line 29, column A. Carry the decimal to four places.

If the amount in column B is more than the amount in column A, fill in 1.00.

.

This is the ratio of your Wisconsin income to federal income . . . . . . . . . . . . . . . . . . . . . . .

30

I-050

1

1 2

2 3

3 4

4