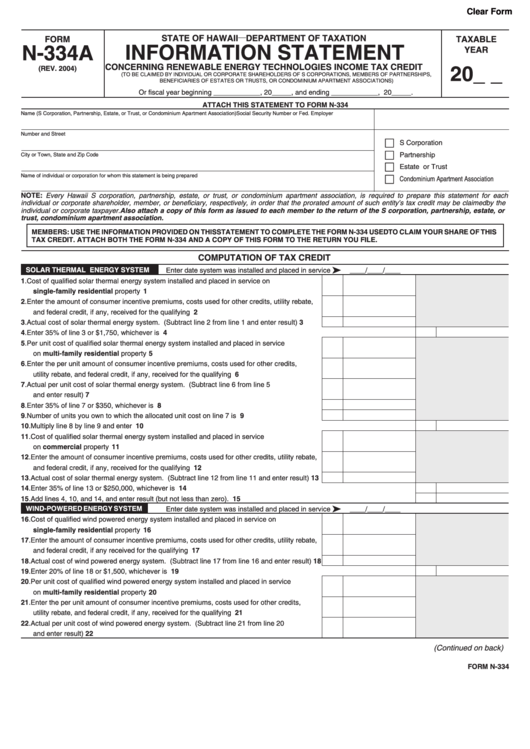

Clear Form

__

STATE OF HAWAII

DEPARTMENT OF TAXATION

FORM

TAXABLE

INFORMATION STATEMENT

N-334A

YEAR

CONCERNING RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT

(REV. 2004)

20_ _

(TO BE CLAIMED BY INDIVIDUAL OR CORPORATE SHAREHOLDERS OF S CORPORATIONS, MEMBERS OF PARTNERSHIPS,

BENEFICIARIES OF ESTATES OR TRUSTS, OR CONDOMINIUM APARTMENT ASSOCIATIONS)

Or fiscal year beginning ____________, 20_____, and ending ____________, 20_____.

ATTACH THIS STATEMENT TO FORM N-334

Name (S Corporation, Partnership, Estate, or Trust, or Condominium Apartment Association)

Social Security Number or Fed. Employer I.D. Number

Number and Street

£

S Corporation

£

Partnership

City or Town, State and Zip Code

£

Estate or Trust

£

Name of individual or corporation for whom this statement is being prepared

Condominium Apartment Association

NOTE: Every Hawaii S corporation, partnership, estate, or trust, or condominium apartment association, is required to prepare this statement for each

individual or corporate shareholder, member, or beneficiary, respectively, in order that the prorated amount of such entity’s tax credit may be claimed by the

individual or corporate taxpayer. Also attach a copy of this form as issued to each member to the return of the S corporation, partnership, estate, or

trust, condominium apartment association.

MEMBERS: USE THE INFORMATION PROVIDED ON THIS STATEMENT TO COMPLETE THE FORM N-334 USED TO CLAIM YOUR SHARE OF THIS

TAX CREDIT. ATTACH BOTH THE FORM N-334 AND A COPY OF THIS FORM TO THE RETURN YOU FILE.

COMPUTATION OF TAX CREDIT

ä

SOLAR THERMAL ENERGY SYSTEM

Enter date system was installed and placed in service

____/____/____

1. Cost of qualified solar thermal energy system installed and placed in service on

single-family residential property ..............................................................................................

1

2. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any, received for the qualifying system........................................................

2

3. Actual cost of solar thermal energy system. (Subtract line 2 from line 1 and enter result)..........

3

4. Enter 35% of line 3 or $1,750, whichever is less ..........................................................................................................................

4

5. Per unit cost of qualified solar thermal energy system installed and placed in service

on multi-family residential property ...........................................................................................

5

6. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

utility rebate, and federal credit, if any, received for the qualifying system ..................................

6

7. Actual per unit cost of solar thermal energy system. (Subtract line 6 from line 5

and enter result) ...........................................................................................................................

7

8. Enter 35% of line 7 or $350, whichever is less.............................................................................

8

9. Number of units you own to which the allocated unit cost on line 7 is applicable ........................

9

10. Multiply line 8 by line 9 and enter result........................................................................................................................................ 10

11. Cost of qualified solar thermal energy system installed and placed in service

on commercial property .............................................................................................................. 11

12. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any, received for the qualifying system........................................................ 12

13. Actual cost of solar thermal energy system. (Subtract line 12 from line 11 and enter result)...... 13

14. Enter 35% of line 13 or $250,000, whichever is less .................................................................................................................... 14

15. Add lines 4, 10, and 14, and enter result (but not less than zero). ............................................................................................... 15

ä

WIND-POWERED ENERGY SYSTEM

Enter date system was installed and placed in service

____/____/____

16. Cost of qualified wind powered energy system installed and placed in service on

single-family residential property .............................................................................................. 16

17. Enter the amount of consumer incentive premiums, costs used for other credits, utility rebate,

and federal credit, if any received for the qualifying system......................................................... 17

18. Actual cost of wind powered energy system. (Subtract line 17 from line 16 and enter result) .... 18

19. Enter 20% of line 18 or $1,500, whichever is less ........................................................................................................................ 19

20. Per unit cost of qualified wind powered energy system installed and placed in service

on multi-family residential property ........................................................................................... 20

21. Enter the per unit amount of consumer incentive premiums, costs used for other credits,

utility rebate, and federal credit, if any, received for the qualifying system .................................. 21

22. Actual per unit cost of wind powered energy system. (Subtract line 21 from line 20

and enter result) ........................................................................................................................... 22

(Continued on back)

FORM N-334

1

1 2

2