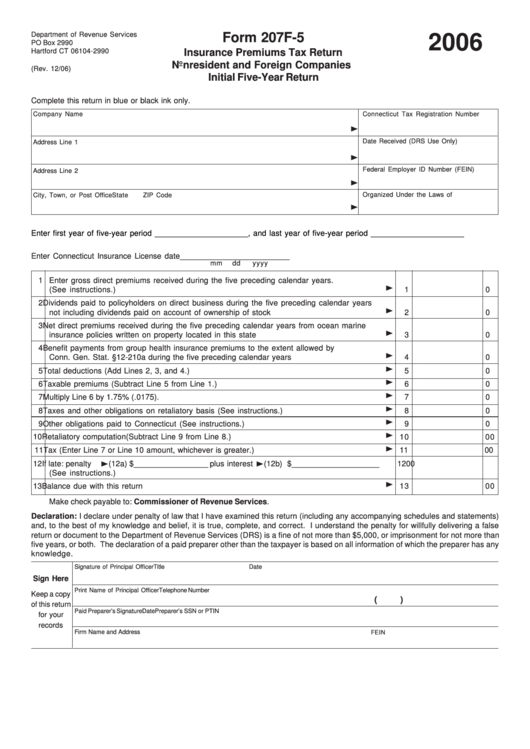

Form 207f-5 - Insurance Premiums Tax Return - Nonresident And Foreign Companies, Initial Five-Year Return - 2006

ADVERTISEMENT

Department of Revenue Services

Form 207F-5

2006

PO Box 2990

Hartford CT 06104-2990

Insurance Premiums Tax Return

Nonresident and Foreign Companies

(Rev. 12/06)

Initial Five-Year Return

Complete this return in blue or black ink only.

Company Name

Connecticut Tax Registration Number

Date Received (DRS Use Only)

Address Line 1

Federal Employer ID Number (FEIN)

Address Line 2

Organized Under the Laws of

City, Town, or Post Office

State

ZIP Code

Enter first year of five-year period _____________________, and last year of five-year period _____________________

Enter Connecticut Insurance License date _________________________

mm

dd

yyyy

1 Enter gross direct premiums received during the five preceding calendar years.

(See instructions.)

1

00

2 Dividends paid to policyholders on direct business during the five preceding calendar years

not including dividends paid on account of ownership of stock

2

00

3 Net direct premiums received during the five preceding calendar years from ocean marine

insurance policies written on property located in this state

3

00

4 Benefit payments from group health insurance premiums to the extent allowed by

Conn. Gen. Stat. §12-210a during the five preceding calendar years

4

00

5 Total deductions (Add Lines 2, 3, and 4.)

5

00

6 Taxable premiums (Subtract Line 5 from Line 1.)

6

00

7 Multiply Line 6 by 1.75% (.0175).

7

00

8 Taxes and other obligations on retaliatory basis (See instructions.)

8

00

9 Other obligations paid to Connecticut (See instructions.)

9

00

10 Retaliatory computation (Subtract Line 9 from Line 8.)

10

00

11 Tax (Enter Line 7 or Line 10 amount, whichever is greater.)

11

00

12 If late: penalty

(12a) $ _________________ plus interest

(12b) $ ____________________

12

00

(See instructions.)

13 Balance due with this return

13

00

Make check payable to: Commissioner of Revenue Services.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false

return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than

five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any

knowledge.

Signature of Principal Officer

Title

Date

Sign Here

Print Name of Principal Officer

Telephone Number

Keep a copy

(

)

of this return

Paid Preparer’s Signature

Date

Preparer’s SSN or PTIN

for your

records

Firm Name and Address

FEIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1