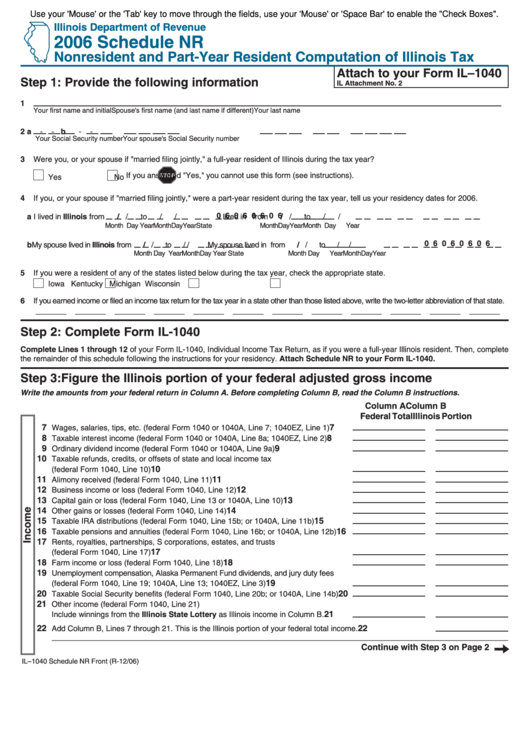

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

2006 Schedule NR

Nonresident and Part-Year Resident Computation of Illinois Tax

Attach to your Form IL–1040

Step 1: Provide the following information

IL Attachment No. 2

1

Your first name and initial

Spouse's first name (and last name if different)

Your last name

2 a

-

-

b

-

-

Your Social Security number

Your spouse's Social Security number

3

Were you, or your spouse if "married filing jointly," a full-year resident of Illinois during the tax year?

If you answered "Yes," you cannot use this form (see instructions).

Yes

No

4

If you, or your spouse if "married filing jointly," were a part-year resident during the tax year, tell us your residency dates for 2006.

0 6

0 6

0 6

0 6

a I lived in Illinois from

/

/

to

/

/

I lived in

from

/

/

to

/

/

Month Day

Year

Month Day

Year

State

Month Day

Year

Month Day

Year

0 6

0 6

0 6

0 6

b My spouse lived in Illinois from

/

/

to

/

/

My spouse lived in

from

/

/

to

/

/

Month Day

Year

Month Day

Year

State

Month Day

Year

Month Day

Year

5

If you were a resident of any of the states listed below during the tax year, check the appropriate state.

Iowa

Kentucky

Michigan

Wisconsin

6

If you earned income or filed an income tax return for the tax year in a state other than those listed above, write the two-letter abbreviation of that state.

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

Step 2: Complete Form IL-1040

Complete Lines 1 through 12 of your Form IL-1040, Individual Income Tax Return, as if you were a full-year Illinois resident. Then, complete

the remainder of this schedule following the instructions for your residency. Attach Schedule NR to your Form IL-1040.

Step 3: Figure the Illinois portion of your federal adjusted gross income

Write the amounts from your federal return in Column A. Before completing Column B, read the Column B instructions.

Column A

Column B

Federal Total

Illinois Portion

7

7

Wages, salaries, tips, etc. (federal Form 1040 or 1040A, Line 7; 1040EZ, Line 1)

8

8

Taxable interest income (federal Form 1040 or 1040A, Line 8a; 1040EZ, Line 2)

9

9

Ordinary dividend income (federal Form 1040 or 1040A, Line 9a)

10

Taxable refunds, credits, or offsets of state and local income tax

10

(federal Form 1040, Line 10)

11

11

Alimony received (federal Form 1040, Line 11)

12

12

Business income or loss (federal Form 1040, Line 12)

13

13

Capital gain or loss (federal Form 1040, Line 13 or 1040A, Line 10)

14

14

Other gains or losses (federal Form 1040, Line 14)

15

15

Taxable IRA distributions (federal Form 1040, Line 15b; or 1040A, Line 11b)

16

16

Taxable pensions and annuities (federal Form 1040, Line 16b; or 1040A, Line 12b)

17

Rents, royalties, partnerships, S corporations, estates, and trusts

17

(federal Form 1040, Line 17)

18

18

Farm income or loss (federal Form 1040, Line 18)

19

Unemployment compensation, Alaska Permanent Fund dividends, and jury duty fees

19

(federal Form 1040, Line 19; 1040A, Line 13; 1040EZ, Line 3)

20

20

Taxable Social Security benefits (federal Form 1040, Line 20b; or 1040A, Line 14b)

21

Other income (federal Form 1040, Line 21)

21

Include winnings from the Illinois State Lottery as Illinois income in Column B.

22

22

Add Column B, Lines 7 through 21. This is the Illinois portion of your federal total income.

Continue with Step 3 on Page 2

IL–1040 Schedule NR Front (R-12/06)

1

1 2

2