Form 24766 - Maximum Levy Worksheet - For Tax Years Beginning - 2005

ADVERTISEMENT

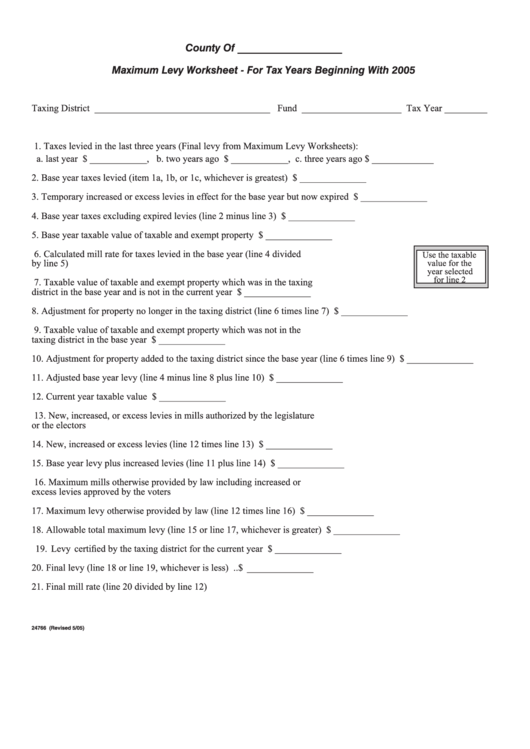

County Of ____________________

Maximum Levy Worksheet - For Tax Years Beginning With 2005

Taxing District _____________________________________ Fund _____________________ Tax Year _________

1. Taxes levied in the last three years (Final levy from Maximum Levy Worksheets):

a. last year $ ____________, b. two years ago $ ____________, c. three years ago

$ _____________

2. Base year taxes levied (item 1a, 1b, or 1c, whichever is greatest) ...............................................$ ______________

3. Temporary increased or excess levies in effect for the base year but now expired .....................$ ______________

4. Base year taxes excluding expired levies (line 2 minus line 3) ...................................................$ ______________

5. Base year taxable value of taxable and exempt property .......................... $ ______________

6. Calculated mill rate for taxes levied in the base year (line 4 divided

Use the taxable

by line 5) ................................................................................................... ______________

value for the

year selected

for line 2

7. Taxable value of taxable and exempt property which was in the taxing

district in the base year and is not in the current year ............................... $ ______________

8. Adjustment for property no longer in the taxing district (line 6 times line 7) .............................$ ______________

9. Taxable value of taxable and exempt property which was not in the

taxing district in the base year ................................................................... $ ______________

10. Adjustment for property added to the taxing district since the base year (line 6 times line 9) ....$ ______________

11. Adjusted base year levy (line 4 minus line 8 plus line 10) ..........................................................$ ______________

12. Current year taxable value ........................................................................ $ ______________

13. New, increased, or excess levies in mills authorized by the legislature

or the electors ............................................................................................ ______________

14. New, increased or excess levies (line 12 times line 13) ............................ $ ______________

15. Base year levy plus increased levies (line 11 plus line 14) ..........................................................$ ______________

16. Maximum mills otherwise provided by law including increased or

excess levies approved by the voters ........................................................ ______________

17. Maximum levy otherwise provided by law (line 12 times line 16) .............................................$ ______________

18. Allowable total maximum levy (line 15 or line 17, whichever is greater) ..................................$ ______________

19. Levy certifi ed by the taxing district for the current year ..............................................................$ ______________

20. Final levy (line 18 or line 19, whichever is less) .........................................................................$ ______________

21. Final mill rate (line 20 divided by line 12) ............................................... ______________ mills

24766 (Revised 5/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2