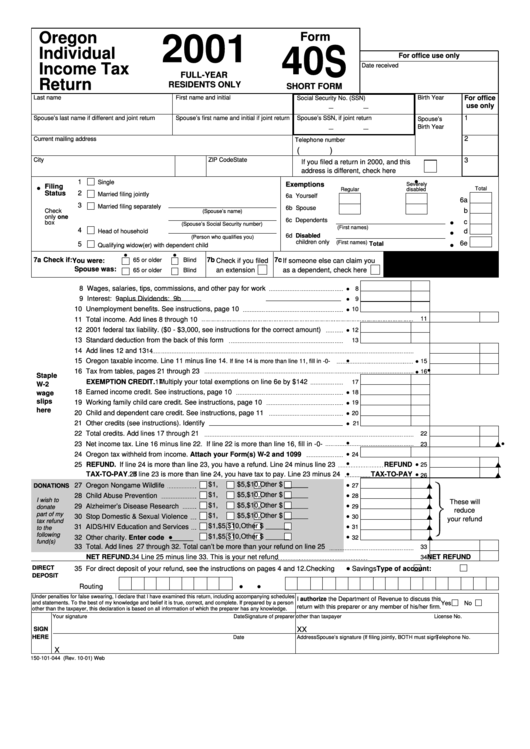

Clear Form

Oregon

Form

2001

S

40

Individual

For office use only

Income Tax

Date received

FULL-YEAR

Return

RESIDENTS ONLY

SHORT FORM

Last name

First name and initial

Birth Year

For office

Social Security No. (SSN)

use only

1

Spouse’s last name if different and joint return

Spouse’s first name and initial if joint return

Spouse’s SSN, if joint return

Spouse’s

Birth Year

2

Current mailing address

Telephone number

(

)

City

State

ZIP Code

3

If you filed a return in 2000, and this

address is different, check here

•

1

Single

Exemptions

Severely

•

Filing

Total

Regular

disabled

Status

2

Married filing jointly

6a Yourself

6a

3

Married filing separately

6b Spouse

b

Check

(Spouse’s name)

only one

6c Dependents

•

c

box

(Spouse’s Social Security number)

(First names)

4

•

d

Head of household

6d Disabled

(Person who qualifies you)

children only

(First names)

•

6e

Total

5

Qualifying widow(er) with dependent child

•

•

7a

Check if: You were:

7b

7c

65 or older

Blind

Check if you filed

If someone else can claim you

Spouse was:

an extension

as a dependent, check here

65 or older

Blind

•

8 Wages, salaries, tips, commissions, and other pay for work

8

•

9 Interest: 9a

plus Dividends: 9b

9

•

10 Unemployment benefits. See instructions, page 10

10

11

11 Total income. Add lines 8 through 10

•

12 2001 federal tax liability. ($0 - $3,000, see instructions for the correct amount)

12

13 Standard deduction from the back of this form

13

14 Add lines 12 and 13

14

•

•

15 Oregon taxable income. Line 11 minus line 14.

If line 14 is more than line 11, fill in -0-

15

•

•

16 Tax from tables, pages 21 through 23

16

Staple

17

EXEMPTION CREDIT.

Multiply your total exemptions on line 6e by $142

17

W-2

•

18 Earned income credit. See instructions, page 10

wage

18

slips

•

19 Working family child care credit. See instructions, page 10

19

here

•

20 Child and dependent care credit. See instructions, page 11

20

•

21 Other credits (see instructions). Identify

21

22 Total credits. Add lines 17 through 21

22

•

•

23 Net income tax. Line 16 minus line 22. If line 22 is more than line 16, fill in -0-

23

•

24 Oregon tax withheld from income. Attach your Form(s) W-2 and 1099

24

•

•

25

REFUND. If line 24 is more than line 23, you have a refund. Line 24 minus line 23

REFUND

25

•

•

26

TAX-TO-PAY.

If line 23 is more than line 24, you have tax to pay. Line 23 minus 24

TAX-TO-PAY

26

•

$1,

$5,

$10,

Other $ ______

27 Oregon Nongame Wildlife

DONATIONS

27

•

$1,

$5,

$10,

Other $ ______

28 Child Abuse Prevention

28

I wish to

These will

•

$1,

$5,

$10,

Other $ ______

29 Alzheimer’s Disease Research

29

donate

reduce

part of my

•

$1,

$5,

$10,

Other $ ______

30 Stop Domestic & Sexual Violence

30

your refund

tax refund

•

$1,

$5,

$10,

Other $ ______

31 AIDS/HIV Education and Services

31

to the

following

•

•

$1,

$5,

$10,

Other $ ______

32 Other charity. Enter code ______

32

fund(s)

33 Total. Add lines 27 through 32. Total can’t be more than your refund on line 25

33

34

NET REFUND.

Line 25 minus line 33. This is your net refund

NET REFUND

34

•

DIRECT

35 For direct deposit of your refund, see the instructions on pages 4 and 12.

Type of account:

Checking

Savings

DEPOSIT

•

•

Routing No.

Account No.

Under penalties for false swearing, I declare that I have examined this return, including accompanying schedules

I authorize the Department of Revenue to discuss this

and statements. To the best of my knowledge and belief it is true, correct, and complete. If prepared by a person

Yes

No

return with this preparer or any member of his/her firm.

other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Your signature

Date

Signature of preparer other than taxpayer

License No.

X

X

SIGN

HERE

Spouse’s signature (If filing jointly, BOTH must sign)

Date

Address

Telephone No.

X

150-101-044 (Rev. 10-01) Web

1

1 2

2