Independent Contractor Agreement For Athletic Related Services Form

ADVERTISEMENT

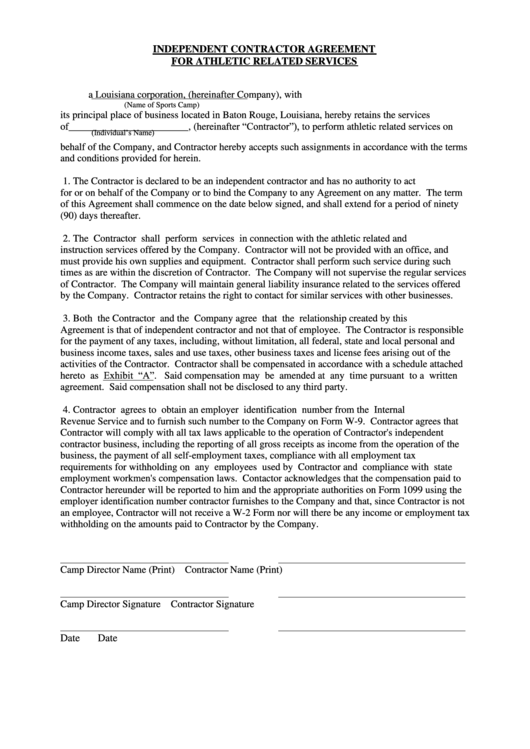

INDEPENDENT CONTRACTOR AGREEMENT

FOR ATHLETIC RELATED SERVICES

a Louisiana corporation, (hereinafter Company), with

(Name of Sports Camp)

its principal place of business located in Baton Rouge, Louisiana, hereby retains the services

of________________________, (hereinafter “Contractor”), to perform athletic related services on

(Individual’s Name)

behalf of the Company, and Contractor hereby accepts such assignments in accordance with the terms

and conditions provided for herein.

1.

The Contractor is declared to be an independent contractor and has no authority to act

for or on behalf of the Company or to bind the Company to any Agreement on any matter. The term

of this Agreement shall commence on the date below signed, and shall extend for a period of ninety

(90) days thereafter.

2.

The Contractor shall perform services in connection with the athletic related and

instruction services offered by the Company. Contractor will not be provided with an office, and

must provide his own supplies and equipment. Contractor shall perform such service during such

times as are within the discretion of Contractor. The Company will not supervise the regular services

of Contractor. The Company will maintain general liability insurance related to the services offered

by the Company. Contractor retains the right to contact for similar services with other businesses.

3.

Both the Contractor and the Company agree that the relationship created by this

Agreement is that of independent contractor and not that of employee. The Contractor is responsible

for the payment of any taxes, including, without limitation, all federal, state and local personal and

business income taxes, sales and use taxes, other business taxes and license fees arising out of the

activities of the Contractor. Contractor shall be compensated in accordance with a schedule attached

hereto as Exhibit “A”. Said compensation may be amended at any time pursuant to a written

agreement. Said compensation shall not be disclosed to any third party.

4.

Contractor agrees to obtain an employer identification number from the Internal

Revenue Service and to furnish such number to the Company on Form W-9. Contractor agrees that

Contractor will comply with all tax laws applicable to the operation of Contractor's independent

contractor business, including the reporting of all gross receipts as income from the operation of the

business, the payment of all self-employment taxes, compliance with all employment tax

requirements for withholding on any employees used by Contractor and compliance with state

employment workmen's compensation laws. Contactor acknowledges that the compensation paid to

Contractor hereunder will be reported to him and the appropriate authorities on Form 1099 using the

employer identification number contractor furnishes to the Company and that, since Contractor is not

an employee, Contractor will not receive a W-2 Form nor will there be any income or employment tax

withholding on the amounts paid to Contractor by the Company.

Camp Director Name (Print)

Contractor Name (Print)

Camp Director Signature

Contractor Signature

Date

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2