Form 5452 - Corporate Report Of Nondividend Distributions 1994

ADVERTISEMENT

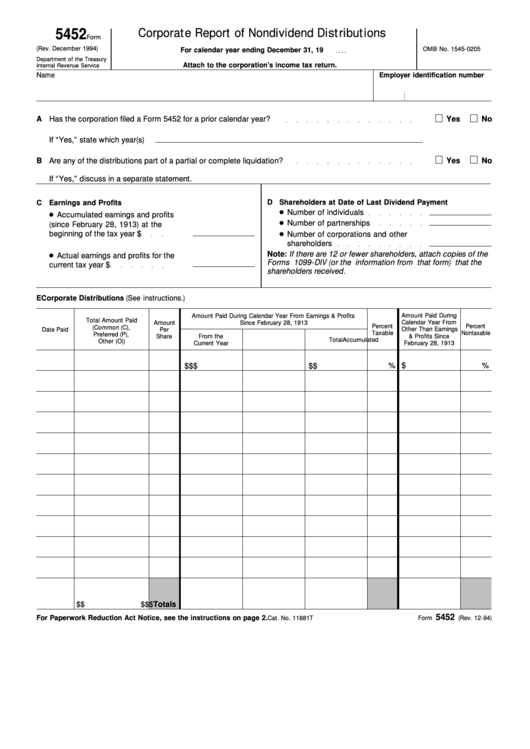

5452

Corporate Report of Nondividend Distributions

Form

(Rev. December 1994)

OMB No. 1545-0205

For calendar year ending December 31, 19

Department of the Treasury

Attach to the corporation’s income tax return.

Internal Revenue Service

Name

Employer identification number

A

Has the corporation filed a Form 5452 for a prior calendar year?

Yes

No

If “Yes,” state which year(s)

B

Are any of the distributions part of a partial or complete liquidation?

Yes

No

If “Yes,” discuss in a separate statement.

D

Shareholders at Date of Last Dividend Payment

C

Earnings and Profits

Number of individuals

Accumulated earnings and profits

Number of partnerships

(since February 28, 1913) at the

beginning of the tax year

$

Number of corporations and other

shareholders

Note: If there are 12 or fewer shareholders, attach copies of the

Actual earnings and profits for the

Forms 1099-DIV (or the information from that form) that the

current tax year

$

shareholders received.

E Corporate Distributions (See instructions.)

Amount Paid During Calendar Year From Earnings & Profits

Amount Paid During

Total Amount Paid

Calendar Year From

Amount

Since February 28, 1913

Percent

Percent

(Common (C),

Date Paid

Per

Other Than Earnings

Taxable

Nontaxable

Preferred (P),

From the

& Profits Since

Share

Accumulated

Total

Other (O))

Current Year

February 28, 1913

%

$

%

$

$

$

$

$

Totals

$

$

$

$

$

5452

For Paperwork Reduction Act Notice, see the instructions on page 2.

Cat. No. 11881T

Form

(Rev. 12-94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4