Schedule C Worksheet

ADVERTISEMENT

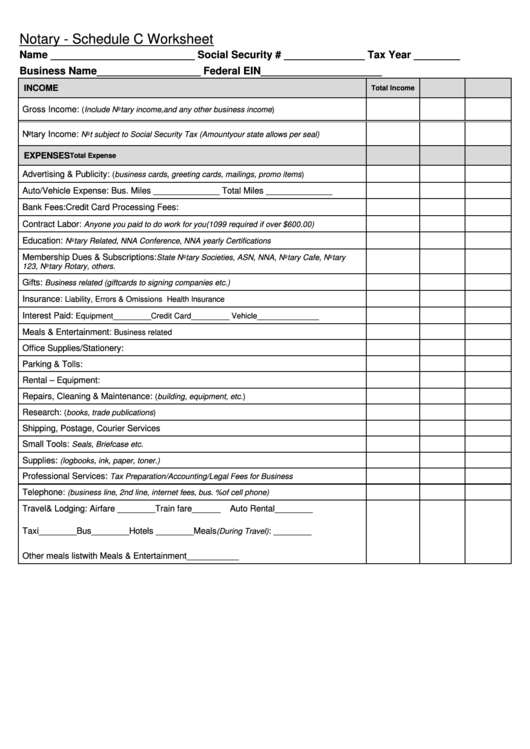

Notary - Schedule C Worksheet

Name _________________________ Social Security # ______________ Tax Year ________

Business Name __________________ Federal EIN _____________________

INCOME

Total Income

Gross Income:

(Include Notary income, and any other business income)

Notary Income:

Not subject to Social Security Tax (Amount your state allows per seal)

EXPENSES

Total Expense

Advertising & Publicity:

(business cards, greeting cards, mailings, promo items)

Auto/Vehicle Expense: Bus. Miles ______________ Total Miles ______________

Bank Fees:

Credit Card Processing Fees:

Contract Labor:

Anyone you paid to do work for you (1099 required if over $600.00)

Education:

Notary Related, NNA Conference, NNA yearly Certifications

Membership Dues & Subscriptions:

State Notary Societies, ASN, NNA, Notary Cafe, Notary

123, Notary Rotary, others.

Gifts:

Business related (gift cards to signing companies etc.)

Insurance:

Liability, Errors & Omissions Health Insurance

Interest Paid:

________

________

_____________

Equipment

Credit Card

Vehicle

Meals & Entertainment:

Business related

Office Supplies/Stationery:

Parking & Tolls:

Rental – Equipment:

Repairs, Cleaning & Maintenance:

(building, equipment, etc.)

Research:

(books, trade publications)

Shipping, Postage, Courier Services

Small Tools:

.

Seals, Briefcase etc

Supplies:

(logbooks, ink, paper, toner.)

Professional Services:

Tax Preparation/Accounting/Legal Fees for Business

Telephone:

(business line, 2nd line, internet fees, bus. % of cell phone)

Travel & Lodging: Airfare ________ Train fare ______

Auto Rental ________

Taxi ________ Bus ________ Hotels ________ Meals

: ________

(During Travel)

Other meals list with Meals & Entertainment___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2