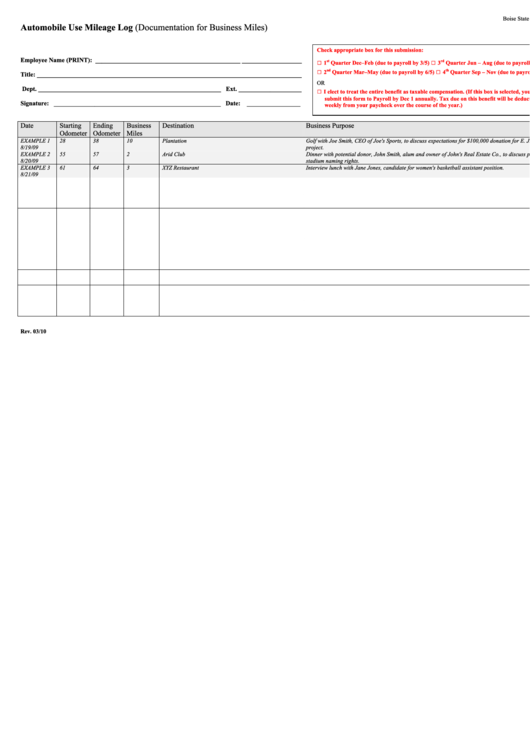

Boise State University

Automobile Use Mileage Log (Documentation for Business Miles)

Check appropriate box for this submission:

Employee Name (PRINT): ______________________________________________ ___________________

□

□

st

rd

1

Quarter Dec–Feb (due to payroll by 3/5)

3

Quarter Jun – Aug (due to payroll 9/5)

□

□

nd

th

2

Quarter Mar–May (due to payroll by 6/5)

4

Quarter Sep – Nov (due to payroll 12/5)

Title: ____________________________________________________________________________________

OR

Dept. __________________________________________________________ Ext. ____________________

□

I elect to treat the entire benefit as taxable compensation. (If this box is selected, you must

submit this form to Payroll by Dec 1 annually. Tax due on this benefit will be deducted bi-

Signature: _____________________________________________________ Date: _________________

weekly from your paycheck over the course of the year.)

Date

Starting

Ending

Business

Destination

Business Purpose

Odometer

Odometer

Miles

EXAMPLE 1

28

38

10

Plantation

Golf with Joe Smith, CEO of Joe's Sports, to discuss expectations for $100,000 donation for E. Jr. High

8/19/09

project.

EXAMPLE 2

55

57

2

Arid Club

Dinner with potential donor, John Smith, alum and owner of John's Real Estate Co., to discuss potential

8/20/09

stadium naming rights.

EXAMPLE 3

61

64

3

XYZ Restaurant

Interview lunch with Jane Jones, candidate for women's basketball assistant position.

8/21/09

Rev. 03/10

1

1 2

2