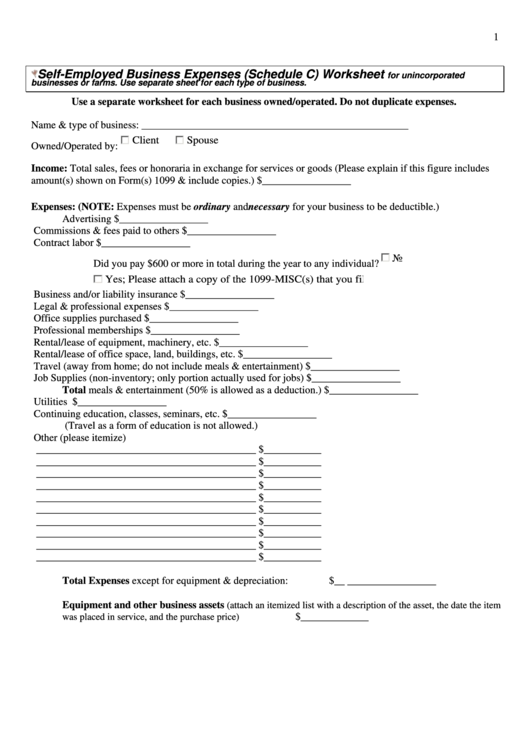

Self-Employed Business Expenses (Schedule C) Worksheet For For Unincorporated Businesses Or Farms

ADVERTISEMENT

1

Self-Employed Business Expenses (Schedule C) Worksheet

for unincorporated

businesses or farms. Use separate sheet for each type of business.

Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

Name & type of business: ___________________________________________________

Client

Spouse

Owned/Operated by:

Income: Total sales, fees or honoraria in exchange for services or goods (Please explain if this figure includes

amount(s) shown on Form(s) 1099 & include copies.)

$_________________

Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.)

Advertising

$_________________

Commissions & fees paid to others

$_________________

Contract labor

$_________________

No

Did you pay $600 or more in total during the year to any individual?

Yes; Please attach a copy of the 1099-MISC(s) that you filed.

Business and/or liability insurance

$_________________

Legal & professional expenses

$_________________

Office supplies purchased

$_________________

Professional memberships

$_________________

Rental/lease of equipment, machinery, etc.

$_________________

Rental/lease of office space, land, buildings, etc.

$_________________

Travel (away from home; do not include meals & entertainment)

$_________________

Job Supplies (non-inventory; only portion actually used for jobs)

$_________________

Total meals & entertainment (50% is allowed as a deduction.)

$_________________

Utilities

$_________________

Continuing education, classes, seminars, etc.

$_________________

(Travel as a form of education is not allowed.)

Other (please itemize)

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

__________________________________________

$___________

Total Expenses except for equipment & depreciation:

$__ _________________

Equipment and other business assets

(attach an itemized list with a description of the asset, the date the item

$_____________

was placed in service, and the purchase price)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2