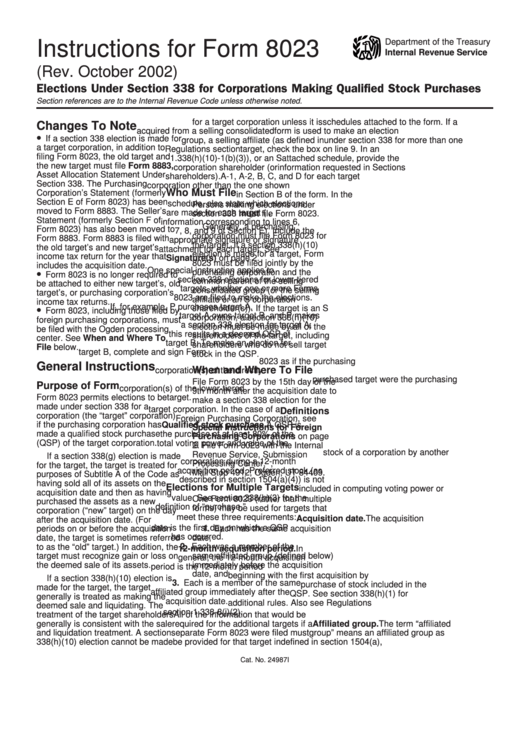

Instructions For Form 8023 (Rev. October 2002)

ADVERTISEMENT

Department of the Treasury

Instructions for Form 8023

Internal Revenue Service

(Rev. October 2002)

Elections Under Section 338 for Corporations Making Qualified Stock Purchases

Section references are to the Internal Revenue Code unless otherwise noted.

for a target corporation unless it is

schedules attached to the form. If a

Changes To Note

acquired from a selling consolidated

form is used to make an election

•

If a section 338 election is made for

group, a selling affiliate (as defined in

under section 338 for more than one

a target corporation, in addition to

Regulations section

target, check the box on line 9. In an

filing Form 8023, the old target and

1.338(h)(10)-1(b)(3)), or an S

attached schedule, provide the

the new target must file Form 8883,

corporation shareholder (or

information requested in Sections

Asset Allocation Statement Under

shareholders).

A-1, A-2, B, C, and D for each target

Section 338. The Purchasing

corporation other than the one shown

Who Must File

Corporation’s Statement (formerly

in Section B of the form. In the

Section E of Form 8023) has been

schedule, also state which elections

Persons making elections under

moved to Form 8883. The Seller’s

are made for each target (i.e.,

section 338 must file Form 8023.

Statement (formerly Section F of

information corresponding to lines 6,

Generally, a purchasing

Form 8023) has also been moved to

7, 8, and 9 of Section E). Include the

corporation must file Form 8023 for

Form 8883. Form 8883 is filed with

appropriate signature or signature

the target. If a section 338(h)(10)

the old target’s and new target’s

attachment for each target. See

election is made for a target, Form

income tax return for the year that

Signature(s) on page 2.

8023 must be filed jointly by the

includes the acquisition date.

•

One special instruction applies to

purchasing corporation and the

Form 8023 is no longer required to

section 338 elections for lower-tiered

common parent of the selling

be attached to either new target’s, old

targets, whether one or more Forms

consolidated group (or the selling

target’s, or purchasing corporation’s

8023 are filed to make the elections.

affiliate or an S corporation

income tax returns.

•

If, for example, P purchases target A,

shareholder(s)). If the target is an S

Form 8023, including those filed by

target A owns target B, and P makes

corporation, a section 338(h)(10)

foreign purchasing corporations, must

a section 338 election for target A,

election must be made by all of the

be filed with the Ogden processing

this results in a deemed QSP of

shareholders of the target, including

center. See When and Where To

target B. To make an election for

shareholders who do not sell target

File below.

target B, complete and sign Form

stock in the QSP.

8023 as if the purchasing

General Instructions

When and Where To File

corporation(s) of the directly

purchased target were the purchasing

File Form 8023 by the 15th day of the

Purpose of Form

corporation(s) of the lower-tiered

9th month after the acquisition date to

Form 8023 permits elections to be

target.

make a section 338 election for the

made under section 338 for a

target corporation. In the case of a

Definitions

corporation (the “target” corporation)

Foreign Purchasing Corporation, see

if the purchasing corporation has

Qualified stock purchase. A QSP is

Special Instructions for Foreign

made a qualified stock purchase

the purchase of at least 80% of the

Purchasing Corporations on page

(QSP) of the target corporation.

total voting power and value of the

2. File Form 8023 with the Internal

stock of a corporation by another

Revenue Service, Submission

If a section 338(g) election is made

corporation during a 12-month

Processing Center, P.O. Box 9941,

for the target, the target is treated for

acquisition period. Preferred stock (as

Mail Stop 4912, Ogden, UT 84409.

purposes of Subtitle A of the Code as

described in section 1504(a)(4)) is not

having sold all of its assets on the

Elections for Multiple Targets

included in computing voting power or

acquisition date and then as having

value. See section 338(h)(3) for the

One Form 8023 (rather than multiple

purchased the assets as a new

definition of “purchase.”

forms) may be used for targets that

corporation (“new” target) on the day

meet these three requirements:

Acquisition date. The acquisition

after the acquisition date. (For

date is the first day on which a QSP

periods on or before the acquisition

1. Each has the same acquisition

has occurred.

date,

date, the target is sometimes referred

2. Each was a member of the

to as the “old” target.) In addition, the

12-month acquisition period. In

target must recognize gain or loss on

same affiliated group (defined below)

general, the 12-month acquisition

immediately before the acquisition

the deemed sale of its assets.

period is the 12-month period

date, and

beginning with the first acquisition by

If a section 338(h)(10) election is

3. Each is a member of the same

purchase of stock included in the

made for the target, the target

affiliated group immediately after the

QSP. See section 338(h)(1) for

generally is treated as making the

acquisition date.

additional rules. Also see Regulations

deemed sale and liquidating. The

section 1.338-8(j)(2).

treatment of the target shareholders

All of the information that would be

generally is consistent with the sale

required for the additional targets if a

Affiliated group. The term “affiliated

and liquidation treatment. A section

separate Form 8023 were filed must

group” means an affiliated group as

338(h)(10) election cannot be made

be provided for that target in

defined in section 1504(a),

Cat. No. 24987I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3