Form Rmft-18 - Schedule Le - Ust And Eif Tax And Fee-Paid Purchases - Illinois Department Of Revenue

ADVERTISEMENT

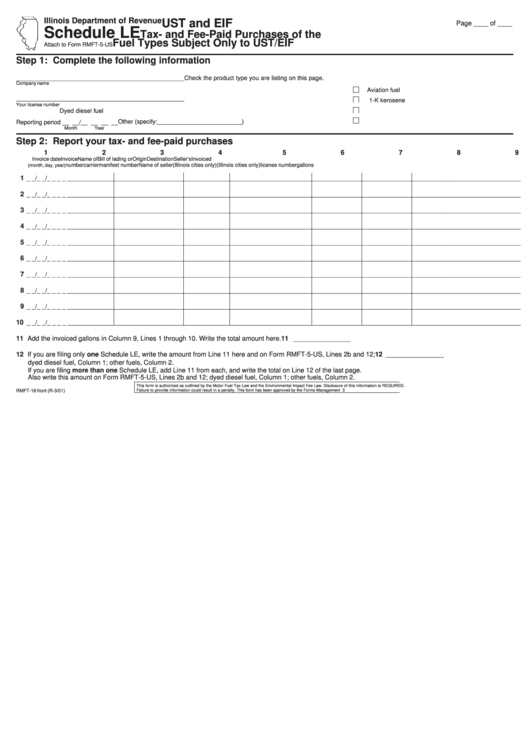

Illinois Department of Revenue

UST and EIF

Page ____ of ____

Schedule LE

Tax- and Fee-Paid Purchases of the

Fuel Types Subject Only to UST/EIF

Attach to Form RMFT-5-US

Step 1: Complete the following information

_________________________________________________

Check the product type you are listing on this page.

Company name

Aviation fuel

_________________________________________________

1-K kerosene

Your license number

Dyed diesel fuel

Other (specify:_________________________)

Reporting period __ __/__ __ __ __

Month

Year

Step 2: Report your tax- and fee-paid purchases

1

2

3

4

5

6

7

8

9

Invoice date

Invoice

Name of

Bill of lading or

Origin

Destination

Seller’s

Invoiced

number

carrier

manifest number

Name of seller

(Illinois cities only)

(Illinois cities only)

license number

gallons

(month, day, year)

1

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

2

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

3

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

4

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

5

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

6

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

7

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

8

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

9

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

10

_ _/_ _/_ _ _ _ ______________________________________________________________________________________________________________________________________

11 Add the invoiced gallons in Column 9, Lines 1 through 10. Write the total amount here.

11

_________________

12 If you are filing only one Schedule LE, write the amount from Line 11 here and on Form RMFT-5-US, Lines 2b and 12;

12

_________________

dyed diesel fuel, Column 1; other fuels, Column 2.

If you are filing more than one Schedule LE, add Line 11 from each, and write the total on Line 12 of the last page.

Also write this amount on Form RMFT-5-US, Lines 2b and 12; dyed diesel fuel, Column 1; other fuels, Column 2.

This form is authorized as outlined by the Motor Fuel Tax Law and the Environmental Impact Fee Law. Disclosure of this information is REQUIRED.

RMFT-18 front (R-3/01)

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2313

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2