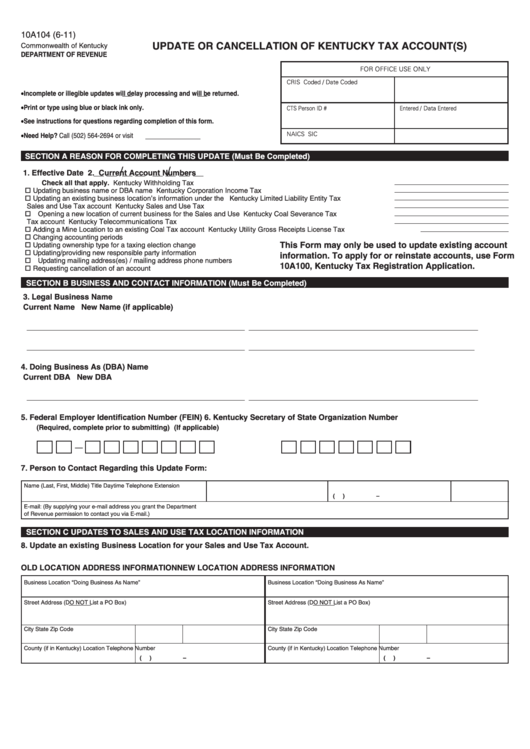

10A104 (6-11)

UPDATE OR CANCELLATION OF KENTUCKY TAX ACCOUNT(S)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

FOR OFFICE USE ONLY

CRIS

Coded / Date Coded

•

Incomplete or illegible updates will delay processing and will be returned.

•

Print or type using blue or black ink only.

CTS Person ID #

Entered / Data Entered

•

See instructions for questions regarding completion of this form.

NAICS

SIC

•

Need Help? Call (502) 564-2694 or visit

SECTION A

REASON FOR COMPLETING THIS UPDATE (Must Be Completed)

/

/

1. Effective Date

2. Current Account Numbers

Check all that apply.

Kentucky Withholding Tax

Updating business name or DBA name

Kentucky Corporation Income Tax

Updating an existing business location’s information under the

Kentucky Limited Liability Entity Tax

Sales and Use Tax account

Kentucky Sales and Use Tax

Opening a new location of current business for the Sales and Use

Kentucky Coal Severance Tax

Tax account

Kentucky Telecommunications Tax

Adding a Mine Location to an existing Coal Tax account

Kentucky Utility Gross Receipts License Tax

Changing accounting periods

This Form may only be used to update existing account

Updating ownership type for a taxing election change

Updating/providing new responsible party information

information. To apply for or reinstate accounts, use Form

Updating mailing address(es) / mailing address phone numbers

10A100, Kentucky Tax Registration Application.

Requesting cancellation of an account

SECTION B

BUSINESS AND CONTACT INFORMATION (Must Be Completed)

3. Legal Business Name

Current Name

New Name (if applicable)

________________________________________________________

_________________________________________________________________

________________________________________________________

__________________________________________________________

4.

Doing Business As (DBA) Name

Current DBA

New DBA

________________________________________________________

_________________________________________________________________

5.

Federal Employer Identification Number (FEIN)

6. Kentucky Secretary of State Organization Number

(Required, complete prior to submitting)

(If applicable)

—

7.

Person to Contact Regarding this Update Form:

Name (Last, First, Middle)

Title

Daytime Telephone

Extension

(

)

–

E-mail: (By supplying your e-mail address you grant the Department

of Revenue permission to contact you via E-mail.)

SECTION C

UPDATES TO SALES AND USE TAX LOCATION INFORMATION

8.

Update an existing Business Location for your Sales and Use Tax Account.

OLD LOCATION ADDRESS INFORMATION

NEW LOCATION ADDRESS INFORMATION

Business Location “Doing Business As Name”

Business Location “Doing Business As Name”

Street Address (DO NOT List a PO Box)

Street Address (DO NOT List a PO Box)

City

State

Zip Code

City

State

Zip Code

County (if in Kentucky)

Location Telephone Number

County (if in Kentucky)

Location Telephone Number

(

)

–

(

)

–

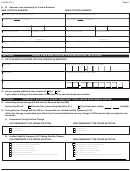

1

1 2

2 3

3 4

4