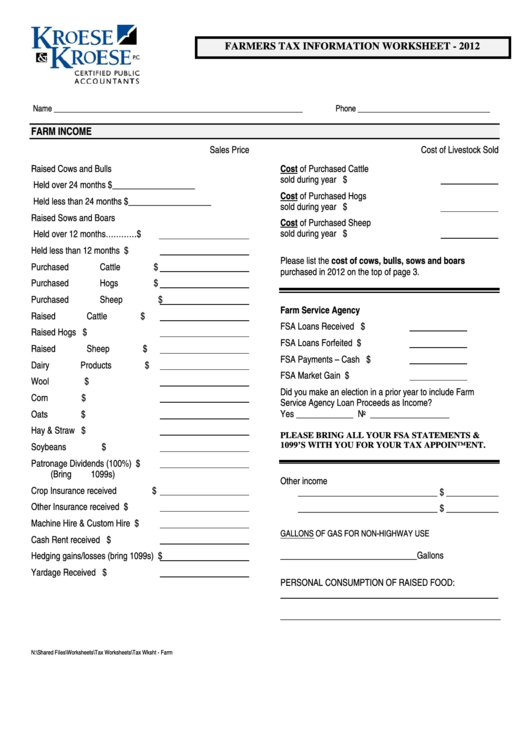

FARMERS TAX INFORMATION WORKSHEET - 2012

Name ________________________________________________________________

Phone __________________________________

FARM INCOME

Sales Price

Cost of Livestock Sold

Raised Cows and Bulls

Cost of Purchased Cattle

sold during year ............................................$

Held over 24 months .............. $ ___________________

Cost of Purchased Hogs

Held less than 24 months ....... $ ___________________

sold during year ............................................$

Raised Sows and Boars

Cost of Purchased Sheep

sold during year ............................................$

Held over 12 months…………$

Held less than 12 months ....... $

Please list the cost of cows, bulls, sows and boars

Purchased Cattle ............................. $

purchased in 2012 on the top of page 3.

Purchased Hogs ............................. $

Purchased Sheep ........................... $

Farm Service Agency

Raised Cattle ................................... $

FSA Loans Received ..................... $

Raised Hogs ................................... $

FSA Loans Forfeited ....................... $

Raised Sheep .................................. $

FSA Payments – Cash ................... $

Dairy Products ................................. $

FSA Market Gain ............................ $

Wool ............................................... $

Did you make an election in a prior year to include Farm

Corn ................................................ $

Service Agency Loan Proceeds as Income?

Yes _____________ No __________________

Oats ................................................. $

Hay & Straw ................................... $

PLEASE BRING ALL YOUR FSA STATEMENTS &

Soybeans ....................................... $

1099’S WITH YOU FOR YOUR TAX APPOINTMENT.

Patronage Dividends (100%) .......... $

(Bring 1099s)

Other income

Crop Insurance received ................ $

________________________________ $ ____________

Other Insurance received ................ $

________________________________ $ ____________

Machine Hire & Custom Hire ........... $

GALLONS OF GAS FOR NON-HIGHWAY USE

Cash Rent received ........................ $

_______________________________Gallons

Hedging gains/losses (bring 1099s) $

Yardage Received .......................... $

PERSONAL CONSUMPTION OF RAISED FOOD:

__________________________________________________

N:\Shared Files\Worksheets\Tax Worksheets\Tax Wksht - Farm 2012.doc

1

1 2

2 3

3