HELP

Complete and use the button at the end to print for mailing.

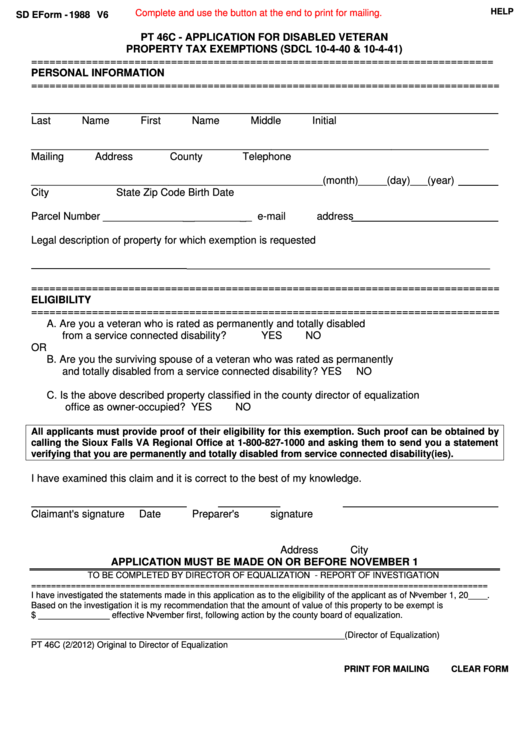

SD EForm - 1988 V6

PT 46C - APPLICATION FOR DISABLED VETERAN

PROPERTY TAX EXEMPTIONS (SDCL 10-4-40 & 10-4-41)

============================================================================

PERSONAL INFORMATION

=============================================================================

Last Name

First Name

Middle Initial

________________________________________________________________________________

Mailing Address

County

Telephone

___________________________________________________(month)_____ (day)___(year)

City

State

Zip Code

Birth Date

Parcel Number __________________________

e-mail address

Legal description of property for which exemption is requested

_____________________________________________________

=============================================================================

ELIGIBILITY

=============================================================================

A. Are you a veteran who is rated as permanently and totally disabled

from a service connected disability?

YES

NO

OR

B. Are you the surviving spouse of a veteran who was rated as permanently

and totally disabled from a service connected disability?

YES

NO

C. Is the above described property classified in the county director of equalization

office as owner-occupied?

YES

NO

All applicants must provide proof of their eligibility for this exemption. Such proof can be obtained by

calling the Sioux Falls VA Regional Office at 1-800-827-1000 and asking them to send you a statement

verifying that you are permanently and totally disabled from service connected disability(ies).

I have examined this claim and it is correct to the best of my knowledge.

Claimant's signature

Date

Preparer's signature

Address

City

APPLICATION MUST BE MADE ON OR BEFORE NOVEMBER 1

TO BE COMPLETED BY DIRECTOR OF EQUALIZATION - REPORT OF INVESTIGATION

============================================================================================

I have investigated the statements made in this application as to the eligibility of the applicant as of November 1, 20____.

Based on the investigation it is my recommendation that the amount of value of this property to be exempt is

$ _______________ effective November first, following action by the county board of equalization.

__________________________________________________________________(Director of Equalization)

PT 46C (2/2012)

Original to Director of Equalization

PRINT FOR MAILING

CLEAR FORM

1

1