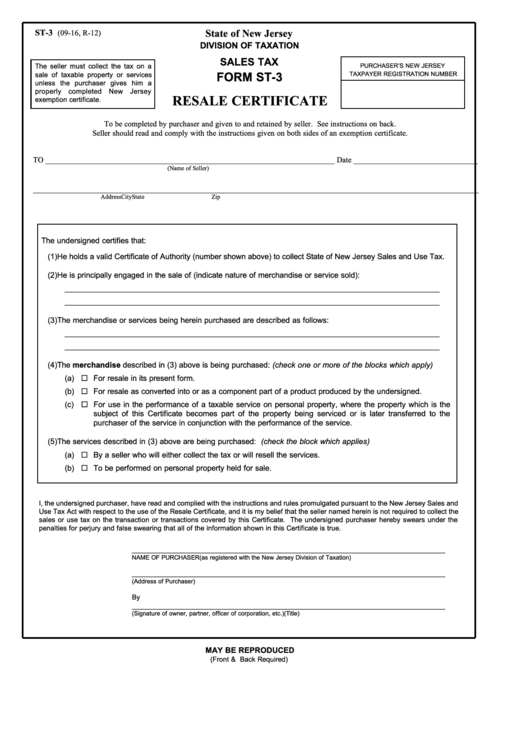

ST-3

(09-16, R-12)

State of New Jersey

DIVISION OF TAXATION

SALES TAX

The seller must collect the tax on a

PURCHASER’S NEW JERSEY

TAXPAYER REGISTRATION NUMBER

sale of taxable property or services

FORM ST-3

unless the purchaser gives him a

properly completed New Jersey

RESALE CERTIFICATE

exemption certificate.

To be completed by purchaser and given to and retained by seller. See instructions on back.

Seller should read and comply with the instructions given on both sides of an exemption certificate.

TO ________________________________________________________________________ Date _______________________________

(Name of Seller)

_______________________________________________________________________________________________________________

Address

City

State

Zip

The undersigned certifies that:

(1) He holds a valid Certificate of Authority (number shown above) to collect State of New Jersey Sales and Use Tax.

(2) He is principally engaged in the sale of (indicate nature of merchandise or service sold):

________________________________________________________________________________________

________________________________________________________________________________________

(3) The merchandise or services being herein purchased are described as follows:

________________________________________________________________________________________

________________________________________________________________________________________

(4) The merchandise described in (3) above is being purchased: (check one or more of the blocks which apply)

(a) ¨ For resale in its present form.

(b) ¨ For resale as converted into or as a component part of a product produced by the undersigned.

(c) ¨ For use in the performance of a taxable service on personal property, where the property which is the

subject of this Certificate becomes part of the property being serviced or is later transferred to the

purchaser of the service in conjunction with the performance of the service.

(5) The services described in (3) above are being purchased: (check the block which applies)

(a) ¨ By a seller who will either collect the tax or will resell the services.

(b) ¨ To be performed on personal property held for sale.

I, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and

Use Tax Act with respect to the use of the Resale Certificate, and it is my belief that the seller named herein is not required to collect the

sales or use tax on the transaction or transactions covered by this Certificate. The undersigned purchaser hereby swears under the

penalties for perjury and false swearing that all of the information shown in this Certificate is true.

___________________________________________________________________________________

NAME OF PURCHASER

(as registered with the New Jersey Division of Taxation)

___________________________________________________________________________________

(Address of Purchaser)

By

___________________________________________________________________________________

(Signature of owner, partner, officer of corporation, etc.)

(Title)

MAY BE REPRODUCED

(Front & Back Required)

1

1 2

2