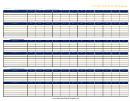

Form 1084 (2015) - Cash Flow Analysis Template Page 8

ADVERTISEMENT

Line 11e - Depreciation: Add back the amount of the depreciation deduction reported on Form 1120.

Line 11f - Depletion: Add back the amount of the depletion deduction reported on Form 1120S.

Line 11g - Amortization/Casualty Loss: Add back the expense deducted for amortization/depletion along with the

expense associated with non-recurring casualty loss.

Line 11h - Net Operating Loss and Special Deductions: Add back the full amount of the deduction related to net

operating loss and/or special deductions.

Line 11i - Mortgage or Notes Payable in Less than 1 Year: Subtract the amount of mortgage or note obligations

payable in less than one year, as reported in Schedule L of Form 1120S, end of year column. This deduction is not

required for lines of credit or if there is evidence that these obligations roll over regularly and/or the business has

sufficient liquid assets to cover them.

Line 11j - Non-deductible Travel and Entertainment Expenses: Deduct the portion of business-related expenses

(travel, meals, and entertainment) reported on Schedule M-1 of Form 1120 that have been excluded for tax reporting

purposes. These expenses, to the full extent they are incurred, are taken into account; therefore, the portion of these

expenses that have been excluded must be identified and subtracted from business cash flow.

Line 11k - Subtotal: Total lines 11a – 11j.

Line 11l - Dividends Paid to Borrower: Dividends paid to stockholders are reported on Schedule M-2 of Form

1120. The borrower's share of these distributions will be reported on Schedule B of Form 1040. These funds are also

included in the corporation's taxable income and are therefore being double-counted. Therefore, subtract distributions

paid by the corporation and reported on the borrower's Schedule B.

Line 11m - Form 1120 Total: Subtract 11l from 11k to determine the adjustments to business tax flow that may be

considered when the borrower(s) own 100% of the corporation and the business has adequate liquidity to support the

withdrawal of earnings.

Instructions

Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8