Form 1084 (2015) - Cash Flow Analysis Template Page 4

ADVERTISEMENT

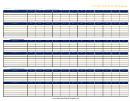

CASH FLOW ANALYSIS (Fannie Mae Form 1084)

Instructions

Guidance for documenting access to income and business liquidity

If the Schedule K-1 reflects a documented, stable history of receiving cash distributions of income from the business

consistent with the level of business income being used to qualify, then no further documentation of access to income

or adequate business liquidity to support the withdrawal of earnings is required in order to include that income in the

borrower’s cash flow.

If the Schedule K-1 does not reflect a documented, stable history of receiving cash distributions of income from the

business consistent with the level of business income being used to qualify, then the lender must confirm the following

to include the income in the borrower’s cash flow:

•

the borrower can document access to the income (for example, via a partnership agreement or corporate

resolution), and

•

the business has adequate liquidity to support the withdrawal of earnings.

Note: The lender is not required to confirm access to the income when the borrower(s) own 100% of the business.

IRS Form 1040 – Individual Income Tax Return

1. W-2 Income from Self-Employment: Identify wages paid to the borrower from the borrower’s business. Self-

employment wages may be confirmed by matching the Employer Identification Number (EIN) reported on the

borrower’s W-2 with the EIN reported by the borrower’s business. When business tax returns are obtained, W-2

wages can be cross-referenced with compensation of officers reported on Form 1120S or Form 1120.

2. Schedule B – Interest and Ordinary Dividends

Line 2a - Interest Income from Self-Employment: Identify interest income paid to the borrower from the borrower’s

business. Review Schedule B, Part I and/or IRS Schedule K-1 or Form 1099-Int to confirm the payer is the same

entity as the borrower’s business.

Line 2b - Dividends from Self-Employment: Identify dividend income paid to the borrower from the borrower’s

business. Review Schedule B, Part II and/or IRS Schedule K-1 or Form 1099-Div to confirm the payer is the same

entity as the borrower’s business.

3. Schedule C – Profit or Loss from Business: Sole Proprietorship

Line 3a - Net Profit or Loss: Record the net profit or (loss) reported on Schedule C.

Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income

that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring.

If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is

determined that the loss will not continue.

Line 3c - Depletion: Add back the amount of the depletion deduction reported on Schedule C.

Line 3d - Depreciation: Add back the amount of the depreciation deduction reported on Schedule C. Vehicle

depreciation included as part of the standard mileage deduction may be added back by multiplying the business miles

driven by the depreciation factor for the respective year.

Instructions

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8