Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel

ADVERTISEMENT

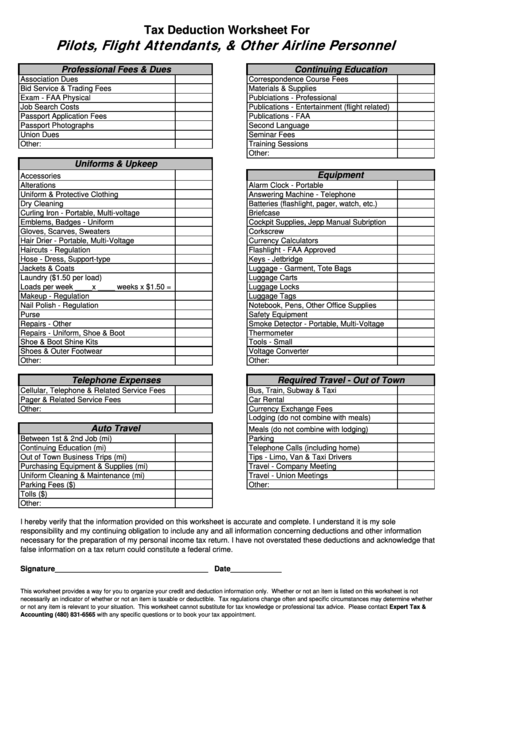

Tax Deduction Worksheet For

Pilots, Flight Attendants, & Other Airline Personnel

Professional Fees & Dues

Continuing Education

Association Dues

Correspondence Course Fees

Bid Service & Trading Fees

Materials & Supplies

Exam - FAA Physical

Publciations - Professional

Job Search Costs

Publications - Entertainment (flight related)

Passport Application Fees

Publications - FAA

Passport Photographs

Second Language

Union Dues

Seminar Fees

Other:

Training Sessions

Other:

Uniforms & Upkeep

Equipment

Accessories

Alterations

Alarm Clock - Portable

Uniform & Protective Clothing

Answering Machine - Telephone

Dry Cleaning

Batteries (flashlight, pager, watch, etc.)

Curling Iron - Portable, Multi-voltage

Briefcase

Emblems, Badges - Uniform

Cockpit Supplies, Jepp Manual Subription

Gloves, Scarves, Sweaters

Corkscrew

Hair Drier - Portable, Multi-Voltage

Currency Calculators

Haircuts - Regulation

Flashlight - FAA Approved

Hose - Dress, Support-type

Keys - Jetbridge

Jackets & Coats

Luggage - Garment, Tote Bags

Laundry ($1.50 per load)

Luggage Carts

Loads per week ____x ____ weeks x $1.50 =

Luggage Locks

Makeup - Regulation

Luggage Tags

Nail Polish - Regulation

Notebook, Pens, Other Office Supplies

Purse

Safety Equipment

Repairs - Other

Smoke Detector - Portable, Multi-Voltage

Repairs - Uniform, Shoe & Boot

Thermometer

Shoe & Boot Shine Kits

Tools - Small

Shoes & Outer Footwear

Voltage Converter

Other:

Other:

Telephone Expenses

Required Travel - Out of Town

Cellular, Telephone & Related Service Fees

Bus, Train, Subway & Taxi

Pager & Related Service Fees

Car Rental

Other:

Currency Exchange Fees

Lodging (do not combine with meals)

Auto Travel

Meals (do not combine with lodging)

Between 1st & 2nd Job (mi)

Parking

Continuing Education (mi)

Telephone Calls (including home)

Out of Town Business Trips (mi)

Tips - Limo, Van & Taxi Drivers

Purchasing Equipment & Supplies (mi)

Travel - Company Meeting

Uniform Cleaning & Maintenance (mi)

Travel - Union Meetings

Parking Fees ($)

Other:

Tolls ($)

Other:

I hereby verify that the information provided on this worksheet is accurate and complete. I understand it is my sole

responsibility and my continuing obligation to include any and all information concerning deductions and other information

necessary for the preparation of my personal income tax return. I have not overstated these deductions and acknowledge that

false information on a tax return could constitute a federal crime.

Signature____________________________________ Date____________

This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not

necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

or not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax &

Accounting (480) 831-6565 with any specific questions or to book your tax appointment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1