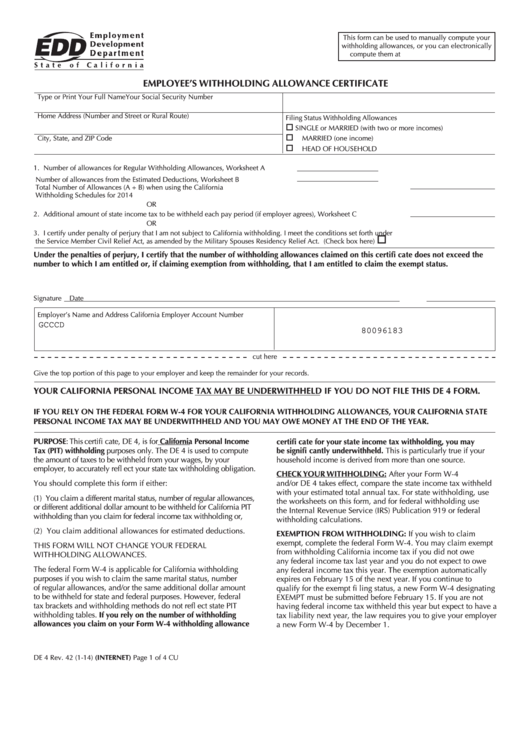

This form can be used to manually compute your

withholding allowances, or you can electronically

compute them at

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Type or Print Your Full Name

Your Social Security Number

Home Address (Number and Street or Rural Route)

Filing Status Withholding Allowances

SINGLE or MARRIED (with two or more incomes)

City, State, and ZIP Code

MARRIED (one income)

HEAD OF HOUSEHOLD

1. Number of allowances for Regular Withholding Allowances, Worksheet A

Number of allowances from the Estimated Deductions, Worksheet B

Total Number of Allowances (A + B) when using the California

Withholding Schedules for 2014

OR

2. Additional amount of state income tax to be withheld each pay period (if employer agrees), Worksheet C

OR

3. I certify under penalty of perjury that I am not subject to California withholding. I meet the conditions set forth under

the Service Member Civil Relief Act, as amended by the Military Spouses Residency Relief Act.

(Check box here)

Under the penalties of perjury, I certify that the number of withholding allowances claimed on this certifi cate does not exceed the

number to which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status.

Signature

Date

Employer’s Name and Address

California Employer Account Number

GCCCD

80096183

cut here

Give the top portion of this page to your employer and keep the remainder for your records.

YOUR CALIFORNIA PERSONAL INCOME TAX MAY BE UNDERWITHHELD IF YOU DO NOT FILE THIS DE 4 FORM.

IF YOU RELY ON THE FEDERAL FORM W-4 FOR YOUR CALIFORNIA WITHHOLDING ALLOWANCES, YOUR CALIFORNIA STATE

PERSONAL INCOME TAX MAY BE UNDERWITHHELD AND YOU MAY OWE MONEY AT THE END OF THE YEAR.

PURPOSE: This certifi cate, DE 4, is for California Personal Income

certifi cate for your state income tax withholding, you may

Tax (PIT) withholding purposes only. The DE 4 is used to compute

be signifi cantly underwithheld. This is particularly true if your

the amount of taxes to be withheld from your wages, by your

household income is derived from more than one source.

employer, to accurately refl ect your state tax withholding obligation.

CHECK YOUR WITHHOLDING: After your Form W-4

and/or DE 4 takes effect, compare the state income tax withheld

You should complete this form if either:

with your estimated total annual tax. For state withholding, use

(1) You claim a different marital status, number of regular allowances,

the worksheets on this form, and for federal withholding use

or different additional dollar amount to be withheld for California PIT

the Internal Revenue Service (IRS) Publication 919 or federal

withholding than you claim for federal income tax withholding or,

withholding calculations.

(2) You claim additional allowances for estimated deductions.

EXEMPTION FROM WITHHOLDING: If you wish to claim

exempt, complete the federal Form W-4. You may claim exempt

THIS FORM WILL NOT CHANGE YOUR FEDERAL

from withholding California income tax if you did not owe

WITHHOLDING ALLOWANCES.

any federal income tax last year and you do not expect to owe

The federal Form W-4 is applicable for California withholding

any federal income tax this year. The exemption automatically

purposes if you wish to claim the same marital status, number

expires on February 15 of the next year. If you continue to

of regular allowances, and/or the same additional dollar amount

qualify for the exempt fi ling status, a new Form W-4 designating

to be withheld for state and federal purposes. However, federal

EXEMPT must be submitted before February 15. If you are not

tax brackets and withholding methods do not refl ect state PIT

having federal income tax withheld this year but expect to have a

withholding tables. If you rely on the number of withholding

tax liability next year, the law requires you to give your employer

allowances you claim on your Form W-4 withholding allowance

a new Form W-4 by December 1.

DE 4 Rev. 42 (1-14) (INTERNET)

Page 1 of 4

CU

1

1 2

2 3

3 4

4