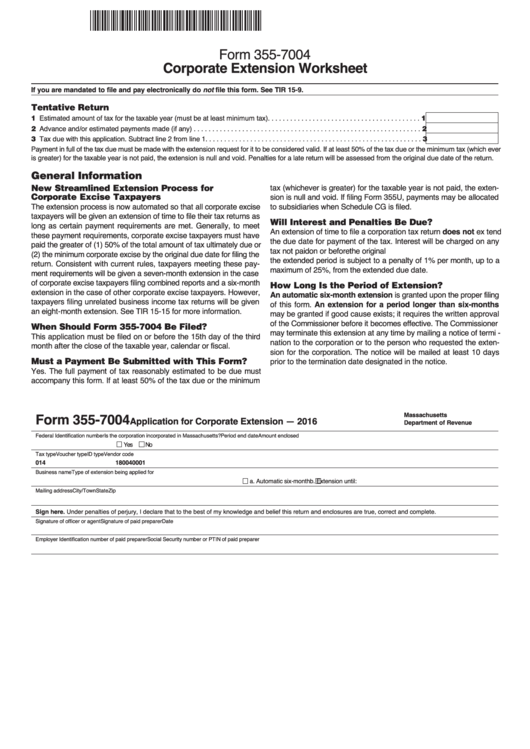

Form 355-7004 - Corporate Extension Worksheet - 2016

ADVERTISEMENT

Form 355-7004

Corporate Extension Worksheet

If you are mandated to file and pay electronically do not file this form. See TIR 15-9.

Tentative Return

1 Estimated amount of tax for the taxable year (must be at least minimum tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Advance and/or estimated payments made (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax due with this application. Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Payment in full of the tax due must be made with the extension request for it to be considered valid. If at least 50% of the tax due or the minimum tax (which ever

is greater) for the taxable year is not paid, the extension is null and void. Penalties for a late return will be assessed from the original due date of the return.

General Information

New Streamlined Extension Process for

tax (whichever is greater) for the taxable year is not paid, the exten-

Corporate Excise Taxpayers

sion is null and void. If filing Form 355U, payments may be allocated

The extension process is now automated so that all corporate excise

to subsidiaries when Schedule CG is filed.

taxpayers will be given an extension of time to file their tax returns as

Will Interest and Penalties Be Due?

long as certain payment requirements are met. Generally, to meet

An extension of time to file a corporation tax return does not ex tend

these payment requirements, corporate excise taxpayers must have

the due date for payment of the tax. Interest will be charged on any

paid the greater of (1) 50% of the total amount of tax ultimately due or

tax not paid on or before the original due date. Any tax not paid within

(2) the minimum corporate excise by the original due date for filing the

the extended period is subject to a penalty of 1% per month, up to a

return. Consistent with current rules, taxpayers meeting these pay-

maximum of 25%, from the extended due date.

ment requirements will be given a seven-month extension in the case

of corporate excise taxpayers filing combined reports and a six-month

How Long Is the Period of Extension?

extension in the case of other corporate excise taxpayers. However,

An automatic six-month extension is granted upon the proper filing

taxpayers filing unrelated business income tax returns will be given

of this form. An extension for a period longer than six-months

an eight-month extension. See TIR 15-15 for more information.

may be granted if good cause exists; it requires the written approval

of the Commissioner before it becomes effective. The Commissioner

When Should Form 355-7004 Be Filed?

may terminate this extension at any time by mailing a notice of termi -

This application must be filed on or before the 15th day of the third

nation to the corporation or to the person who requested the exten-

month after the close of the taxable year, calendar or fiscal.

sion for the corporation. The notice will be mailed at least 10 days

Must a Payment Be Submitted with This Form?

prior to the termination date designated in the notice.

Yes. The full payment of tax reasonably estimated to be due must

accompany this form. If at least 50% of the tax due or the minimum

Massachusetts

Form 355-7004

Application for Corporate Extension — 2016

Department of Revenue

Federal Identification number

Is the corporation incorporated in Massachusetts?

Period end date

Amount enclosed

Yes

No

Tax type

Voucher type

ID type

Vendor code

014

18

004

0001

Business name

Type of extension being applied for

a. Automatic six-month

b. Extension until:

Mailing address

City/Town

State

Zip

Sign here. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of officer or agent

Signature of paid preparer

Date

Employer Identification number of paid preparer

Social Security number or PTIN of paid preparer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2