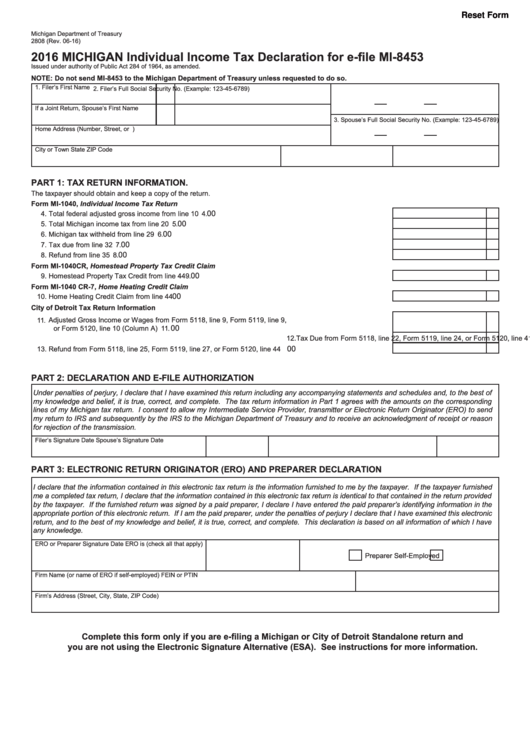

Reset Form

Michigan Department of Treasury

2808 (Rev. 06-16)

2016 MICHIGAN Individual Income Tax Declaration for e-file MI-8453

Issued under authority of Public Act 284 of 1964, as amended.

NOTE: Do not send MI-8453 to the Michigan Department of Treasury unless requested to do so.

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, or P.O. Box)

City or Town

State

ZIP Code

PART 1: TAX RETURN INFORMATION.

The taxpayer should obtain and keep a copy of the return.

Form MI-1040, Individual Income Tax Return

00

4. Total federal adjusted gross income from line 10 .........................................................................................

4.

00

5. Total Michigan income tax from line 20 ........................................................................................................

5.

00

6. Michigan tax withheld from line 29 ...............................................................................................................

6.

00

7. Tax due from line 32 .....................................................................................................................................

7.

00

8. Refund from line 35 ......................................................................................................................................

8.

Form MI-1040CR, Homestead Property Tax Credit Claim

00

9. Homestead Property Tax Credit from line 44 ................................................................................................

9.

Form MI-1040 CR-7, Home Heating Credit Claim

00

10. Home Heating Credit Claim from line 44 ......................................................................................................

10.

City of Detroit Tax Return Information

11. Adjusted Gross Income or Wages from Form 5118, line 9, Form 5119, line 9,

00

or Form 5120, line 10 (Column A) ................................................................................................................

11.

00

12. Tax Due from Form 5118, line 22, Form 5119, line 24, or Form 5120, line 41 .............................................

12.

00

13. Refund from Form 5118, line 25, Form 5119, line 27, or Form 5120, line 44 ...............................................

13.

PART 2: DECLARATION AND E-FILE AUTHORIZATION

Under penalties of perjury, I declare that I have examined this return including any accompanying statements and schedules and, to the best of

my knowledge and belief, it is true, correct, and complete. The tax return information in Part 1 agrees with the amounts on the corresponding

lines of my Michigan tax return. I consent to allow my Intermediate Service Provider, transmitter or Electronic Return Originator (ERO) to send

my return to IRS and subsequently by the IRS to the Michigan Department of Treasury and to receive an acknowledgment of receipt or reason

for rejection of the transmission.

Filer’s Signature

Date

Spouse’s Signature

Date

PART 3: ELECTRONIC RETURN ORIGINATOR (ERO) AND PREPARER DECLARATION

I declare that the information contained in this electronic tax return is the information furnished to me by the taxpayer. If the taxpayer furnished

me a completed tax return, I declare that the information contained in this electronic tax return is identical to that contained in the return provided

by the taxpayer. If the furnished return was signed by a paid preparer, I declare I have entered the paid preparer’s identifying information in the

appropriate portion of this electronic return. If I am the paid preparer, under the penalties of perjury I declare that I have examined this electronic

return, and to the best of my knowledge and belief, it is true, correct, and complete. This declaration is based on all information of which I have

any knowledge.

ERO or Preparer Signature

Date

ERO is (check all that apply)

Preparer

Self-Employed

Firm Name (or name of ERO if self-employed)

FEIN or PTIN

Firm’s Address (Street, City, State, ZIP Code)

Complete this form only if you are e-filing a Michigan or City of Detroit Standalone return and

you are not using the Electronic Signature Alternative (ESA). See instructions for more information.

1

1 2

2