Income Tax Refund Request Form - City Of Springfield, Ohio

ADVERTISEMENT

1

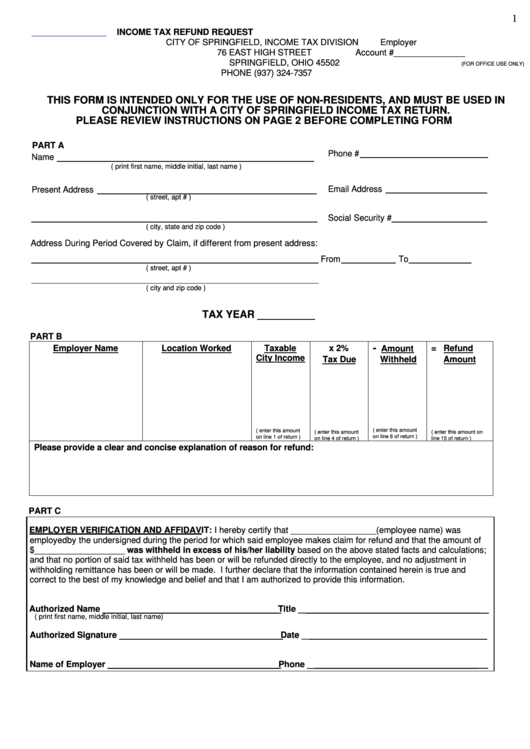

INCOME TAX REFUND REQUEST

CITY OF SPRINGFIELD, INCOME TAX DIVISION

Employer

76 EAST HIGH STREET

Account #_______________

SPRINGFIELD, OHIO 45502

(FOR OFFICE USE ONLY)

PHONE (937) 324-7357

THIS FORM IS INTENDED ONLY FOR THE USE OF NON-RESIDENTS, AND MUST BE USED IN

CONJUNCTION WITH A CITY OF SPRINGFIELD INCOME TAX RETURN.

PLEASE REVIEW INSTRUCTIONS ON PAGE 2 BEFORE COMPLETING FORM

PART A

Phone #

Name

( print first name, middle initial, last name )

Email Address

Present Address

( street, apt # )

Social Security #

( city, state and zip code )

Address During Period Covered by Claim, if different from present address:

From

To

( street, apt # )

( city and zip code )

TAX YEAR __________

PART B

-

Employer Name

Location Worked

Taxable

x 2%

Amount

= Refund

City Income

Tax Due

Withheld

Amount

( enter this amount

( enter this amount

( enter this amount

( enter this amount on

on line 6 of return )

on line 1 of return )

on line 4 of return )

line 15 of return )

Please provide a clear and concise explanation of reason for refund:

PART C

EMPLOYER VERIFICATION AND AFFIDAVIT: I hereby certify that __________________(employee name) was

employed by the undersigned during the period for which said employee makes claim for refund and that the amount of

$___________________ was withheld in excess of his/her liability based on the above stated facts and calculations;

and that no portion of said tax withheld has been or will be refunded directly to the employee, and no adjustment in

withholding remittance has been or will be made. I further declare that the information contained herein is true and

correct to the best of my knowledge and belief and that I am authorized to provide this information.

Authorized Name _____________________________________ Title ______________________________________

( print first name, middle initial, last name)

Authorized Signature __________________________________ Date _____________________________________

Name of Employer ____________________________________ Phone ____________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2