City of Rosenberg

Hotel Occupancy Tax Return

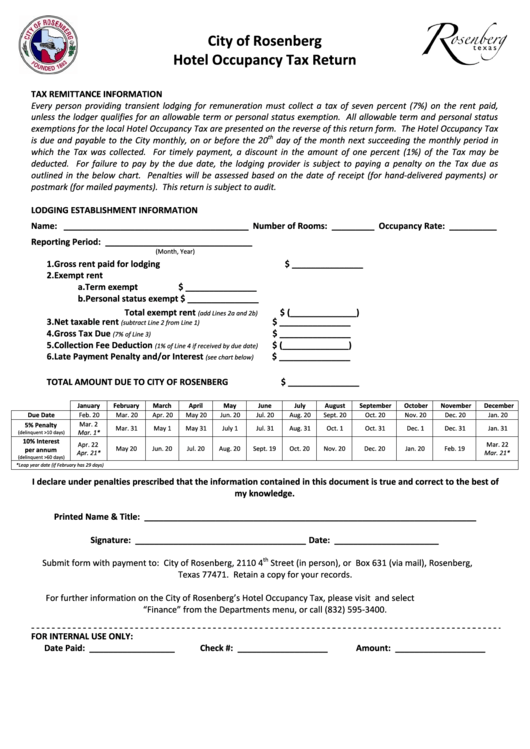

TAX REMITTANCE INFORMATION

Every person providing transient lodging for remuneration must collect a tax of seven percent (7%) on the rent paid,

unless the lodger qualifies for an allowable term or personal status exemption. All allowable term and personal status

exemptions for the local Hotel Occupancy Tax are presented on the reverse of this return form. The Hotel Occupancy Tax

th

is due and payable to the City monthly, on or before the 20

day of the month next succeeding the monthly period in

which the Tax was collected. For timely payment, a discount in the amount of one percent (1%) of the Tax may be

deducted. For failure to pay by the due date, the lodging provider is subject to paying a penalty on the Tax due as

outlined in the below chart. Penalties will be assessed based on the date of receipt (for hand‐delivered payments) or

postmark (for mailed payments). This return is subject to audit.

LODGING ESTABLISHMENT INFORMATION

Name: _ ______________________________________ Number of Rooms: _________ Occupancy Rate: __________

Reporting Period: _______________________________

(Month, Year)

1. Gross rent paid for lodging

$ _______________

2. Exempt rent

a. Term exempt

$ _______________

b. Personal status exempt $ _______________

Total exempt rent

$ (______________)

(add Lines 2a and 2b)

3. Net taxable rent

$ _______________

(subtract Line 2 from Line 1)

4. Gross Tax Due

$ _______________

(7% of Line 3)

5. Collection Fee Deduction

$ (______________)

(1% of Line 4 if received by due date)

6. Late Payment Penalty and/or Interest

$ _______________

(see chart below)

TOTAL AMOUNT DUE TO CITY OF ROSENBERG

$ _______________

January

February

March

April

May

June

July

August

September

October

November

December

Due Date

Feb. 20

Mar. 20

Apr. 20

May 20

Jun. 20

Jul. 20

Aug. 20

Sept. 20

Oct. 20

Nov. 20

Dec. 20

Jan. 20

Mar. 2

5% Penalty

Mar. 31

May 1

May 31

July 1

Jul. 31

Aug. 31

Oct. 1

Oct. 31

Dec. 1

Dec. 31

Jan. 31

Mar. 1*

(delinquent >10 days)

10% Interest

Apr. 22

Mar. 22

May 20

Jun. 20

Jul. 20

Aug. 20

Sept. 19

Oct. 20

Nov. 20

Dec. 20

Jan. 20

Feb. 19

per annum

Apr. 21*

Mar. 21*

(delinquent >60 days)

*Leap year date (if February has 29 days)

I declare under penalties prescribed that the information contained in this document is true and correct to the best of

my knowledge.

Printed Name & Title: ______________________________________________________________________

Signature: ____________________________________ Date: ______________________

th

Submit form with payment to: City of Rosenberg, 2110 4

Street (in person), or P.O. Box 631 (via mail), Rosenberg,

Texas 77471. Retain a copy for your records.

For further information on the City of Rosenberg’s Hotel Occupancy Tax, please visit ci.rosenberg.tx.us and select

“Finance” from the Departments menu, or call (832) 595‐3400.

FOR INTERNAL USE ONLY:

Date Paid: __________________

Check #: ___________________

Amount: ___________________

1

1 2

2