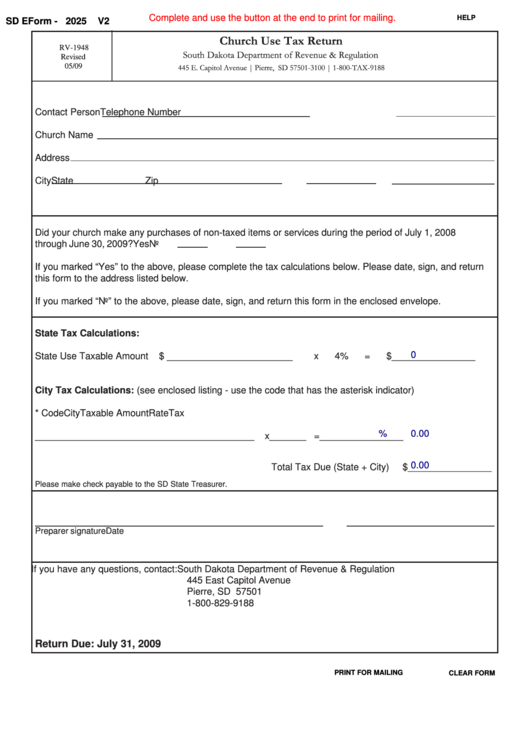

Form Rv-1948 - Church Use Tax Return

ADVERTISEMENT

Complete and use the button at the end to print for mailing.

HELP

SD EForm -

2025

V2

Church Use Tax Return

RV-1948

South Dakota Department of Revenue & Regulation

Revised

05/09

445 E. Capitol Avenue | Pierre, SD 57501-3100 | 1-800-TAX-9188

Contact Person

Telephone Number

Church Name

Address

City

State

Zip

Did your church make any purchases of non-taxed items or services during the period of July 1, 2008

through June 30, 2009?

Yes

No

If you marked “Yes” to the above, please complete the tax calculations below. Please date, sign, and return

this form to the address listed below.

If you marked “No” to the above, please date, sign, and return this form in the enclosed envelope.

State Tax Calculations:

0

State Use Taxable Amount

$ ________________________

x

4%

=

$ ________________

City Tax Calculations: (see enclosed listing - use the code that has the asterisk indicator)

* Code

City

Taxable Amount

Rate

Tax

%

0.00

________

__________________

________________

x

_______ =

________________

0.00

Total Tax Due (State + City)

$ ________________

Please make check payable to the SD State Treasurer.

Preparer signature

Date

If you have any questions, contact: South Dakota Department of Revenue & Regulation

445 East Capitol Avenue

Pierre, SD 57501

1-800-829-9188

bustax@state.sd.us

Return Due: July 31, 2009

PRINT FOR MAILING

CLEAR FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3