2013 Instructions For Idaho Form 41a

ADVERTISEMENT

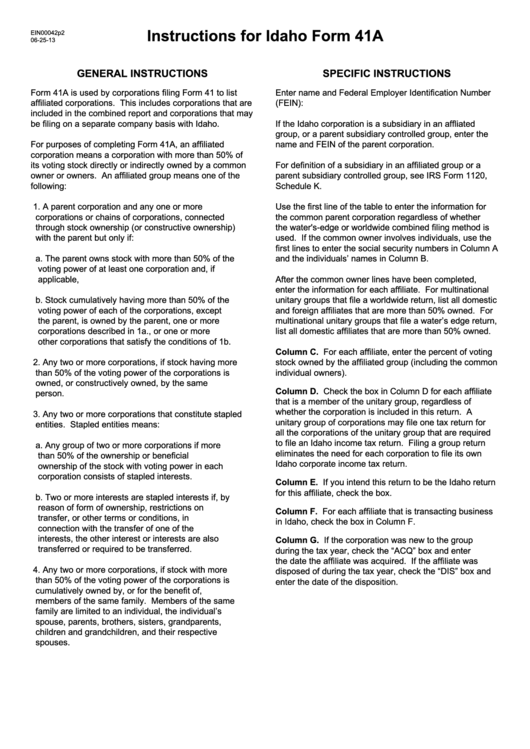

Instructions for Idaho Form 41A

EIN00042p2

06-25-13

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Form 41A is used by corporations filing Form 41 to list

Enter name and Federal Employer Identification Number

affiliated corporations. This includes corporations that are

(FEIN):

included in the combined report and corporations that may

be filing on a separate company basis with Idaho.

If the Idaho corporation is a subsidiary in an affliated

group, or a parent subsidiary controlled group, enter the

For purposes of completing Form 41A, an affiliated

name and FEIN of the parent corporation.

corporation means a corporation with more than 50% of

its voting stock directly or indirectly owned by a common

For definition of a subsidiary in an affiliated group or a

owner or owners. An affiliated group means one of the

parent subsidiary controlled group, see IRS Form 1120,

following:

Schedule K.

1. A parent corporation and any one or more

Use the first line of the table to enter the information for

corporations or chains of corporations, connected

the common parent corporation regardless of whether

through stock ownership (or constructive ownership)

the water's-edge or worldwide combined filing method is

with the parent but only if:

used. If the common owner involves individuals, use the

first lines to enter the social security numbers in Column A

a. The parent owns stock with more than 50% of the

and the individuals’ names in Column B.

voting power of at least one corporation and, if

applicable,

After the common owner lines have been completed,

enter the information for each affiliate. For multinational

b. Stock cumulatively having more than 50% of the

unitary groups that file a worldwide return, list all domestic

voting power of each of the corporations, except

and foreign affiliates that are more than 50% owned. For

the parent, is owned by the parent, one or more

multinational unitary groups that file a water’s edge return,

corporations described in 1a., or one or more

list all domestic affiliates that are more than 50% owned.

other corporations that satisfy the conditions of 1b.

Column C. For each affiliate, enter the percent of voting

2. Any two or more corporations, if stock having more

stock owned by the affiliated group (including the common

than 50% of the voting power of the corporations is

individual owners).

owned, or constructively owned, by the same

Column D. Check the box in Column D for each affiliate

person.

that is a member of the unitary group, regardless of

whether the corporation is included in this return. A

3. Any two or more corporations that constitute stapled

unitary group of corporations may file one tax return for

entities. Stapled entities means:

all the corporations of the unitary group that are required

to file an Idaho income tax return. Filing a group return

a. Any group of two or more corporations if more

eliminates the need for each corporation to file its own

than 50% of the ownership or beneficial

Idaho corporate income tax return.

ownership of the stock with voting power in each

corporation consists of stapled interests.

Column E. If you intend this return to be the Idaho return

for this affiliate, check the box.

b. Two or more interests are stapled interests if, by

reason of form of ownership, restrictions on

Column F. For each affiliate that is transacting business

transfer, or other terms or conditions, in

in Idaho, check the box in Column F.

connection with the transfer of one of the

interests, the other interest or interests are also

Column G. If the corporation was new to the group

transferred or required to be transferred.

during the tax year, check the “ACQ” box and enter

the date the affiliate was acquired. If the affiliate was

4. Any two or more corporations, if stock with more

disposed of during the tax year, check the “DIS” box and

than 50% of the voting power of the corporations is

enter the date of the disposition.

cumulatively owned by, or for the benefit of,

members of the same family. Members of the same

family are limited to an individual, the individual’s

spouse, parents, brothers, sisters, grandparents,

children and grandchildren, and their respective

spouses.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1