Instructions For Idaho Form 41es

ADVERTISEMENT

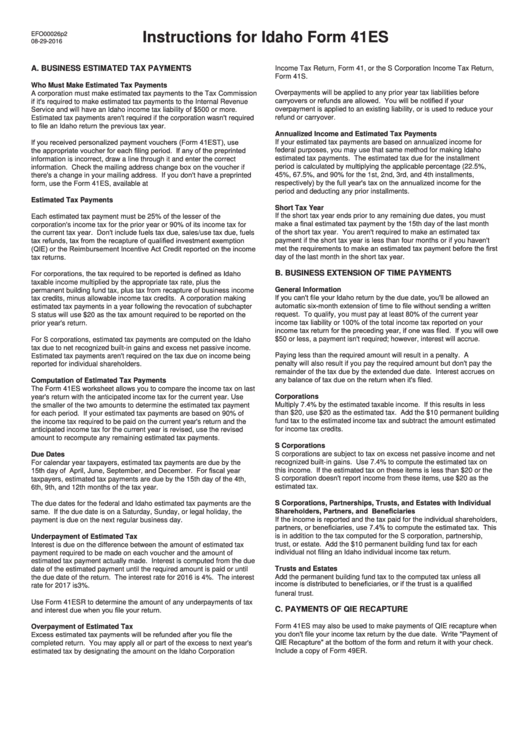

Instructions for Idaho Form 41ES

EFO00026p2

08-29-2016

A. BUSINESS ESTIMATED TAX PAYMENTS

Income Tax Return, Form 41, or the S Corporation Income Tax Return,

Form 41S.

Who Must Make Estimated Tax Payments

Overpayments will be applied to any prior year tax liabilities before

A corporation must make estimated tax payments to the Tax Commission

carryovers or refunds are allowed. You will be notified if your

if it's required to make estimated tax payments to the Internal Revenue

overpayment is applied to an existing liability, or is used to reduce your

Service and will have an Idaho income tax liability of $500 or more.

refund or carryover.

Estimated tax payments aren't required if the corporation wasn't required

to file an Idaho return the previous tax year.

Annualized Income and Estimated Tax Payments

If your estimated tax payments are based on annualized income for

If you received personalized payment vouchers (Form 41EST), use

federal purposes, you may use that same method for making Idaho

the appropriate voucher for each filing period. If any of the preprinted

estimated tax payments. The estimated tax due for the installment

information is incorrect, draw a line through it and enter the correct

period is calculated by multiplying the applicable percentage (22.5%,

information. Check the mailing address change box on the voucher if

45%, 67.5%, and 90% for the 1st, 2nd, 3rd, and 4th installments,

there's a change in your mailing address. If you don't have a preprinted

respectively) by the full year's tax on the annualized income for the

form, use the Form 41ES, available at tax.idaho.gov.

period and deducting any prior installments.

Estimated Tax Payments

Short Tax Year

If the short tax year ends prior to any remaining due dates, you must

Each estimated tax payment must be 25% of the lesser of the

make a final estimated tax payment by the 15th day of the last month

corporation's income tax for the prior year or 90% of its income tax for

of the short tax year. You aren't required to make an estimated tax

the current tax year. Don't include fuels tax due, sales/use tax due, fuels

payment if the short tax year is less than four months or if you haven't

tax refunds, tax from the recapture of qualified investment exemption

met the requirements to make an estimated tax payment before the first

(QIE) or the Reimbursement Incentive Act Credit reported on the income

day of the last month in the short tax year.

tax returns.

B. BUSINESS EXTENSION OF TIME PAYMENTS

For corporations, the tax required to be reported is defined as Idaho

taxable income multiplied by the appropriate tax rate, plus the

General Information

permanent building fund tax, plus tax from recapture of business income

If you can't file your Idaho return by the due date, you'll be allowed an

tax credits, minus allowable income tax credits. A corporation making

automatic six-month extension of time to file without sending a written

estimated tax payments in a year following the revocation of subchapter

request. To qualify, you must pay at least 80% of the current year

S status will use $20 as the tax amount required to be reported on the

income tax liability or 100% of the total income tax reported on your

prior year's return.

income tax return for the preceding year, if one was filed. If you will owe

$50 or less, a payment isn't required; however, interest will accrue.

For S corporations, estimated tax payments are computed on the Idaho

tax due to net recognized built-in gains and excess net passive income.

Paying less than the required amount will result in a penalty. A

Estimated tax payments aren't required on the tax due on income being

penalty will also result if you pay the required amount but don't pay the

reported for individual shareholders.

remainder of the tax due by the extended due date. Interest accrues on

any balance of tax due on the return when it's filed.

Computation of Estimated Tax Payments

The Form 41ES worksheet allows you to compare the income tax on last

Corporations

year's return with the anticipated income tax for the current year. Use

Multiply 7.4% by the estimated taxable income. If this results in less

the smaller of the two amounts to determine the estimated tax payment

than $20, use $20 as the estimated tax. Add the $10 permanent building

for each period. If your estimated tax payments are based on 90% of

fund tax to the estimated income tax and subtract the amount estimated

the income tax required to be paid on the current year's return and the

for income tax credits.

anticipated income tax for the current year is revised, use the revised

amount to recompute any remaining estimated tax payments.

S Corporations

S corporations are subject to tax on excess net passive income and net

Due Dates

recognized built-in gains. Use 7.4% to compute the estimated tax on

For calendar year taxpayers, estimated tax payments are due by the

this income. If the estimated tax on these items is less than $20 or the

15th day of April, June, September, and December. For fiscal year

S corporation doesn't report income from these items, use $20 as the

taxpayers, estimated tax payments are due by the 15th day of the 4th,

estimated tax.

6th, 9th, and 12th months of the tax year.

S Corporations, Partnerships, Trusts, and Estates with Individual

The due dates for the federal and Idaho estimated tax payments are the

Shareholders, Partners, and Beneficiaries

same. If the due date is on a Saturday, Sunday, or legal holiday, the

If the income is reported and the tax paid for the individual shareholders,

payment is due on the next regular business day.

partners, or beneficiaries, use 7.4% to compute the estimated tax. This

is in addition to the tax computed for the S corporation, partnership,

Underpayment of Estimated Tax

trust, or estate. Add the $10 permanent building fund tax for each

Interest is due on the difference between the amount of estimated tax

individual not filing an Idaho individual income tax return.

payment required to be made on each voucher and the amount of

estimated tax payment actually made. Interest is computed from the due

Trusts and Estates

date of the estimated payment until the required amount is paid or until

Add the permanent building fund tax to the computed tax unless all

the due date of the return. The interest rate for 2016 is 4%. The interest

income is distributed to beneficiaries, or if the trust is a qualified

rate for 2017 is 3%.

funeral trust.

Use Form 41ESR to determine the amount of any underpayments of tax

C. PAYMENTS OF QIE RECAPTURE

and interest due when you file your return.

Form 41ES may also be used to make payments of QIE recapture when

Overpayment of Estimated Tax

you don't file your income tax return by the due date. Write "Payment of

Excess estimated tax payments will be refunded after you file the

QIE Recapture" at the bottom of the form and return it with your check.

completed return. You may apply all or part of the excess to next year's

Include a copy of Form 49ER.

estimated tax by designating the amount on the Idaho Corporation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1