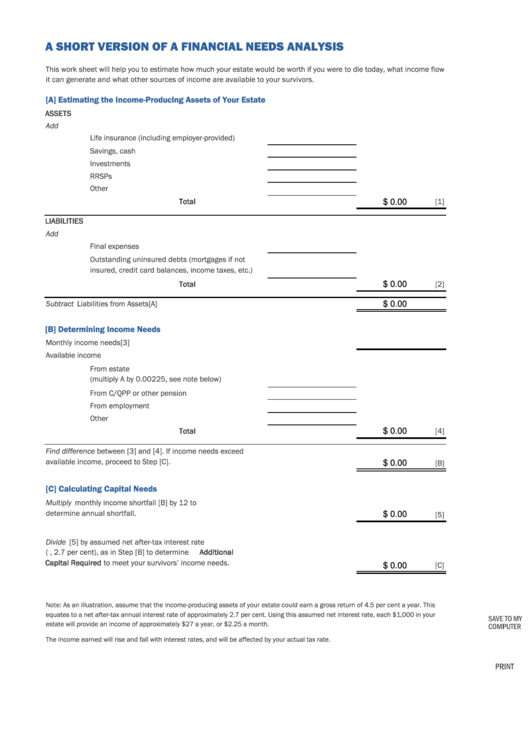

A SHORT VERSION OF A FINANCIAL NEEDS ANALYSIS

This work sheet will help you to estimate how much your estate would be worth if you were to die today, what income flow

it can generate and what other sources of income are available to your survivors.

[A] Estimating the Income-Producing Assets of Your Estate

ASSETS

Add

Life insurance (including employer-provided)

Savings, cash

Investments

RRSPs

Other

Total

[1]

$ 0.00

LIABILITIES

Add

Final expenses

Outstanding uninsured debts (mortgages if not

insured, credit card balances, income taxes, etc.)

Total

[2]

$ 0.00

Subtract Liabilities from Assets

[A]

$ 0.00

[B] Determining Income Needs

Monthly income needs

[3]

Available income

From estate

(multiply A by 0.00225, see note below)

From C/QPP or other pension

From employment

Other

Total

[4]

$ 0.00

Find difference between [3] and [4]. If income needs exceed

available income, proceed to Step [C].

[B]

$ 0.00

[C] Calculating Capital Needs

Multiply monthly income shortfall [B] by 12 to

determine annual shortfall.

[5]

$ 0.00

Divide [5] by assumed net after-tax interest rate

(e.g., 2.7 per cent), as in Step [B] to determine Additional

Capital Required to meet your survivors’ income needs.

[C]

$ 0.00

Note: As an illustration, assume that the income-producing assets of your estate could earn a gross return of 4.5 per cent a year. This

equates to a net after-tax annual interest rate of approximately 2.7 per cent. Using this assumed net interest rate, each $1,000 in your

estate will provide an income of approximately $27 a year, or $2.25 a month.

The income earned will rise and fall with interest rates, and will be affected by your actual tax rate.

1

1