Dr 1059 - Exemption From Withholding For A Qualifying Spouse Of A U.s. Armed Forces Servicemember - Colorado Department Of Revenue

ADVERTISEMENT

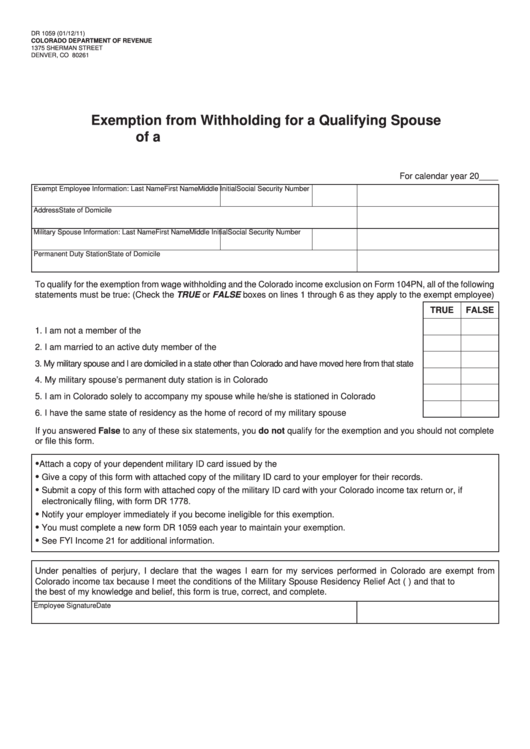

DR 1059 (01/12/11)

COLORADO DEPARTMENT OF REVENUE

1375 SHERMAN STREET

DENVER, CO 80261

Exemption from Withholding for a Qualifying Spouse

of a U.S. Armed Forces Servicemember

For calendar year 20____

Exempt Employee Information: Last Name

First Name

Middle Initial Social Security Number

Address

State of Domicile

Military Spouse Information: Last Name

First Name

Middle Initial Social Security Number

Permanent Duty Station

State of Domicile

To qualify for the exemption from wage withholding and the Colorado income exclusion on Form 104PN, all of the following

statements must be true: (Check the TRUE or FALSE boxes on lines 1 through 6 as they apply to the exempt employee)

TRUE

FALSE

1. I am not a member of the U.S. armed forces ....................................................................................

2. I am married to an active duty member of the U.S. armed forces .....................................................

3. My military spouse and I are domiciled in a state other than Colorado and have moved here from that state

4. My military spouse’s permanent duty station is in Colorado .............................................................

5. I am in Colorado solely to accompany my spouse while he/she is stationed in Colorado ................

6. I have the same state of residency as the home of record of my military spouse .............................

If you answered False to any of these six statements, you do not qualify for the exemption and you should not complete

or file this form.

•

Attach a copy of your dependent military ID card issued by the U.S. Department of Defense.

•

Give a copy of this form with attached copy of the military ID card to your employer for their records.

•

Submit a copy of this form with attached copy of the military ID card with your Colorado income tax return or, if

electronically filing, with form DR 1778.

•

Notify your employer immediately if you become ineligible for this exemption.

•

You must complete a new form DR 1059 each year to maintain your exemption.

•

See FYI Income 21 for additional information.

Under penalties of perjury, I declare that the wages I earn for my services performed in Colorado are exempt from

Colorado income tax because I meet the conditions of the Military Spouse Residency Relief Act (P.L. 111-97) and that to

the best of my knowledge and belief, this form is true, correct, and complete.

Employee Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1