New York State Department of Taxation and Finance

New York State Department of Taxation and Finance

For office use only

For office use only

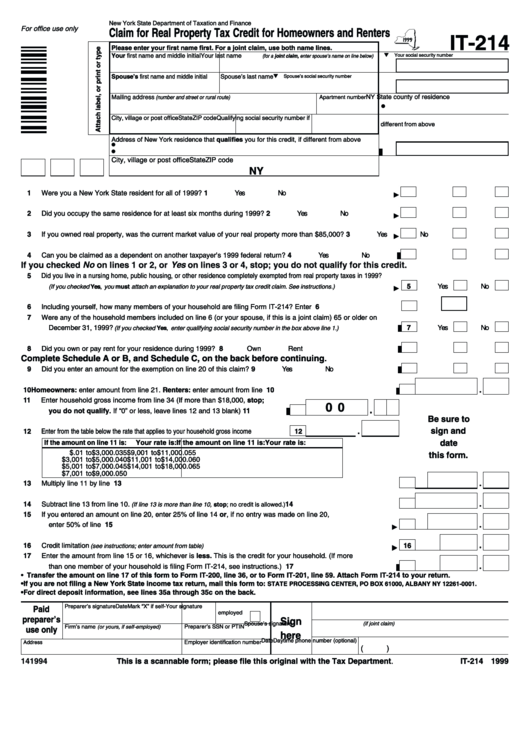

Claim for Real Property Tax Credit for Homeowners and Renters

Claim for Real Property Tax Credit for Homeowners and Renters

IT-214

IT-214

Please enter your first name first. For a joint claim, use both name lines.

Please enter your first name first. For a joint claim, use both name lines.

M

M

Your first name and middle initial

Your first name and middle initial

Your last name

Your last name

Your social security number

Your social security number

(for a joint claim, enter spouse’s name on line below)

(for a joint claim, enter spouse’s name on line below)

M

M

Spouse’s first name and middle initial

Spouse’s first name and middle initial

Spouse’s last name

Spouse’s last name

Spouse’s social security number

Spouse’s social security number

NY State county of residence

NY State county of residence

Mailing address

Mailing address

(number and street or rural route)

(number and street or rural route)

Apartment number

Apartment number

City, village or post office

City, village or post office

State

State

ZIP code

ZIP code

Qualifying social security number if

Qualifying social security number if

different from above

different from above

Address of New York residence that qualifies you for this credit, if different from above

Address of New York residence that qualifies you for this credit, if different from above

•

•

•

•

City, village or post office

City, village or post office

State

State

ZIP code

ZIP code

NY

NY

1

1

Were you a New York State resident for all of 1999? ...................................................................................................

Were you a New York State resident for all of 1999? ...................................................................................................

1

1

Yes

Yes

No

No

2

2

Did you occupy the same residence for at least six months during 1999? ..................................................................

Did you occupy the same residence for at least six months during 1999? ..................................................................

2

2

Yes

Yes

No

No

3

3

If you owned real property, was the current market value of your real property more than $85,000? .........................

If you owned real property, was the current market value of your real property more than $85,000? .........................

3

3

Yes

Yes

No

No

4

4

Can you be claimed as a dependent on another taxpayer’s 1999 federal return? .......................................................

Can you be claimed as a dependent on another taxpayer’s 1999 federal return? .......................................................

4

4

Yes

Yes

No

No

If you checked No on lines 1 or 2, or Yes on lines 3 or 4, stop; you do not qualify for this credit.

5

5

Did you live in a nursing home, public housing, or other residence completely exempted from real property taxes in 1999?

Did you live in a nursing home, public housing, or other residence completely exempted from real property taxes in 1999?

5

5

Yes

Yes

No

No

(If you checked Yes, you must attach an explanation to your real property tax credit claim. See instructions.) ..................................

(If you checked Yes, you must attach an explanation to your real property tax credit claim. See instructions.) ..................................

6

6

Including yourself, how many members of your household are filing Form IT-214? Enter number .............................

Including yourself, how many members of your household are filing Form IT-214? Enter number .............................

6

6

7

7

Were any of the household members included on line 6 (or your spouse, if this is a joint claim) 65 or older on

Were any of the household members included on line 6 (or your spouse, if this is a joint claim) 65 or older on

December 31, 1999?

December 31, 1999?

7

7

Yes

Yes

No

No

(If you checked Yes, enter qualifying social security number in the box above line 1.) ................................

(If you checked Yes, enter qualifying social security number in the box above line 1.) ................................

8

8

Did you own or pay rent for your residence during 1999? ............................................................................................

Did you own or pay rent for your residence during 1999? ............................................................................................

8

8

Own

Own

Rent

Rent

Complete Schedule A or B, and Schedule C, on the back before continuing.

Complete Schedule A or B, and Schedule C, on the back before continuing.

9

9

Did you enter an amount for the exemption on line 20 of this claim? ..........................................................................

Did you enter an amount for the exemption on line 20 of this claim? ..........................................................................

9

9

Yes

Yes

No

No

10

10

Homeowners: enter amount from line 21. Renters: enter amount from line 25 .........................................................

Homeowners: enter amount from line 21. Renters: enter amount from line 25 .........................................................

10

10

11

11

Enter household gross income from line 34 (If more than $18,000, stop;

Enter household gross income from line 34 (If more than $18,000, stop;

0 0

0 0

you do not qualify. If “0” or less, leave lines 12 and 13 blank) .....................

you do not qualify. If “0” or less, leave lines 12 and 13 blank) .....................

11

11

Be sure to

Be sure to

sign and

sign and

12

12

Enter from the table below the rate that applies to your household gross income .................

Enter from the table below the rate that applies to your household gross income .................

12

12

If the amount on line 11 is:

If the amount on line 11 is:

Your rate is:

Your rate is:

If the amount on line 11 is:

If the amount on line 11 is:

Your rate is:

Your rate is:

date

date

$.01 to $3,000

$.01 to $3,000

.035

.035

$9,001 to $11,000

$9,001 to $11,000

.055

.055

this form.

this form.

$3,001 to $5,000

$3,001 to $5,000

.040

.040

$11,001 to $14,000

$11,001 to $14,000

.060

.060

$5,001 to $7,000

$5,001 to $7,000

.045

.045

$14,001 to $18,000

$14,001 to $18,000

.065

.065

$7,001 to $9,000

$7,001 to $9,000

.050

.050

13

13

Multiply line 11 by line 12 .................................................................................................................................................

Multiply line 11 by line 12 .................................................................................................................................................

13

13

14

14

Subtract line 13 from line 10.

Subtract line 13 from line 10.

.........................................................

.........................................................

14

14

(If line 13 is more than line 10, stop; no credit is allowed.)

(If line 13 is more than line 10, stop; no credit is allowed.)

15

15

If you entered an amount on line 20, enter 25% of line 14 or, if no entry was made on line 20,

If you entered an amount on line 20, enter 25% of line 14 or, if no entry was made on line 20,

enter 50% of line 14 ..................................................................................................................................................

enter 50% of line 14 ..................................................................................................................................................

15

15

16

16

Credit limitation

Credit limitation

16

16

(see instructions; enter amount from table) .............................................................................................................

(see instructions; enter amount from table) .............................................................................................................

17

17

Enter the amount from line 15 or 16, whichever is less. This is the credit for your household. (If more

Enter the amount from line 15 or 16, whichever is less. This is the credit for your household. (If more

than one member of your household is filing Form IT-214, see instructions.) .........................................................

than one member of your household is filing Form IT-214, see instructions.) .........................................................

17

17

• Transfer the amount on line 17 of this form to Form IT-200, line 36, or to Form IT-201, line 59. Attach Form IT-214 to your return.

• Transfer the amount on line 17 of this form to Form IT-200, line 36, or to Form IT-201, line 59. Attach Form IT-214 to your return.

• If you are not filing a New York State income tax return, mail this form to:

• If you are not filing a New York State income tax return, mail this form to:

STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY 12261-0001.

STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY 12261-0001.

• For direct deposit information, see lines 35a through 35c on the back.

• For direct deposit information, see lines 35a through 35c on the back.

Preparer’s signature

Preparer’s signature

Date

Date

Mark “X” if self-

Mark “X” if self-

Your signature

Your signature

Paid

Paid

employed

employed

preparer’s

preparer’s

Sign

Sign

Spouse’s signature

Spouse’s signature

(if joint claim)

(if joint claim)

Firm’s name

Firm’s name

Preparer’s SSN or PTIN

Preparer’s SSN or PTIN

(or yours, if self-employed)

(or yours, if self-employed)

use only

use only

here

here

Date

Date

Daytime phone number (optional)

Daytime phone number (optional)

Employer identification number

Employer identification number

Address

Address

(

(

)

)

141994

This is a scannable form; please file this original with the Tax Department.

This is a scannable form; please file this original with the Tax Department.

IT-214 1999

IT-214 1999

1

1 2

2