F0699N

(Rev. 6-11)

Page 3 of 4

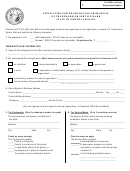

INFORMATION ABOUT MEDICAL INSURANCE

(Please include copies of both sides of your medical cards.)

Type of Coverage

Policy Number:

Ins urance Company/ Addres s

Policy holder who pays premiums

DOCTOR

Me

Noncustodial parent

Effective Date:

HOSPITA L

Other (Provide name and relationship to

child, custodial party, or noncustodial parent.)

V ISION

Name(s) of insured dependent(s):

Type of Coverage

Policy Number:

Ins urance Company/ Addres s

Policy holder who pays premiums

Me

Noncustodial parent

DENTA L

Effective Date:

Other (Provide name and relationship to

child, custodial party, or noncustodial parent.)

Name(s) of insured dependent(s):

Type of Coverage

Policy Numbe

Ins urance Company/ Addres s

Policy holder who pays premiums

r:

Me

Noncustodial parent

PRESCRIPTION

Effective Date:

Other (Provide name and relationship to

child, custodial party, or noncustodial parent.)

Name(s) of insured dependent(s):

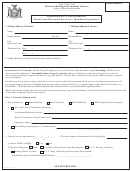

INFORMATION ABOUT FEDERAL INCOME TAX REFUND & ADMINISTRATIV E OFFSET

Following are the conditions for submittal of child support debts for collection by federal income tax and

administrative offset:

(1) There is a valid court or administrative order for child support.

(2) The noncustodial parent has an arrearage of at least: (A ) $500 for federal income tax refund offset, or (B)

$25 for administrative offset.

(3) The noncustodial parent' s social security number has been verified.

(4) There is a $15.00 fee for each name certified to the IRS for the withholding of the noncustodial parent' s

federal income tax refund. This fee is deducted from any amounts payable to you. You do not have to pay

this fee unless there is a withholding.

(5) There is no guarantee that monies will be collected on your behalf.

(6) If an income tax refund offset is made on your behalf, the State has the authority to hold the refund (if it

involves a joint return) six months before sending the collection to you.

(7) If the support order was not entered in this State, we must have a copy of the order and any modifications,

and a copy of the support payment record or a signed affidavit from you, before the case can be submitted

for offset.

(8) If you have received public assistance in the past, any child support debt owed to the State may be satisfied

before any debt owed to you.

(9) You are personally liable for the return of any amounts you receive that are paid erroneously, including any

amounts that must be returned due to the filing of an amended return by the noncustodial parent' s spouse.

1

1 2

2 3

3 4

4