Form Gc-11-2 - Fsa Health Care Reimbursement

ADVERTISEMENT

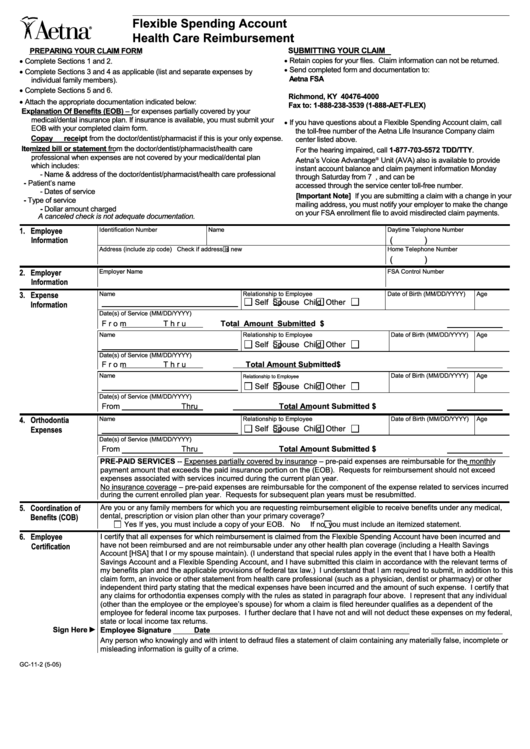

Flexible Spending Account

Health Care Reimbursement

PREPARING YOUR CLAIM FORM

SUBMITTING YOUR CLAIM

•

•

Retain copies for your files. Claim information can not be returned.

Complete Sections 1 and 2.

•

Send completed form and documentation to:

•

Complete Sections 3 and 4 as applicable (list and separate expenses by

Aetna FSA

individual family members).

P.O. Box 4000

•

Complete Sections 5 and 6.

Richmond, KY 40476-4000

•

Attach the appropriate documentation indicated below:

Fax to: 1-888-238-3539 (1-888-AET-FLEX)

Explanation Of Benefits (EOB) – for expenses partially covered by your

medical/dental insurance plan. If insurance is available, you must submit your

•

If you have questions about a Flexible Spending Account claim, call

EOB with your completed claim form.

the toll-free number of the Aetna Life Insurance Company claim

Copay receipt from the doctor/dentist/pharmacist if this is your only expense.

center listed above.

Itemized bill or statement from the doctor/dentist/pharmacist/health care

For the hearing impaired, call 1-877-703-5572 TDD/TTY.

professional when expenses are not covered by your medical/dental plan

Aetna’s Voice Advantage

®

Unit (AVA) also is available to provide

which includes:

instant account balance and claim payment information Monday

- Name & address of the doctor/dentist/pharmacist/health care professional

through Saturday from 7 a.m. to 12 midnight ET, and can be

- Patient’s name

accessed through the service center toll-free number

.

- Dates of service

[Important Note] If you are submitting a claim with a change in your

- Type of service

mailing address, you must notify your employer to make the change

- Dollar amount charged

on your FSA enrollment file to avoid misdirected claim payments.

A canceled check is not adequate documentation.

1. Employee

Identification Number

Name

Daytime Telephone Number

(

)

Information

Address (include zip code)

Check if address is new

Home Telephone Number

(

)

2. Employer

Employer Name

FSA Control Number

Information

3. Expense

Name

Relationship to Employee

Date of Birth (MM/DD/YYYY)

Age

Self

Spouse

Child

Other

Information

Date(s) of Service (MM/DD/YYYY)

From

Thru

Total Amount Submitted

$

Name

Relationship to Employee

Date of Birth (MM/DD/YYYY)

Age

Self

Spouse

Child

Other

Date(s) of Service (MM/DD/YYYY)

From

Thru

Total Amount Submitted

$

Name

Date of Birth (MM/DD/YYYY)

Age

Relationship to Employee

Self

Spouse

Child

Other

Date(s) of Service (MM/DD/YYYY)

From

Thru

Total Amount Submitted

$

4. Orthodontia

Name

Relationship to Employee

Date of Birth (MM/DD/YYYY)

Age

Expenses

Self

Spouse

Child

Other

Date(s) of Service (MM/DD/YYYY)

From

Thru

Total Amount Submitted

$

PRE-PAID SERVICES -- Expenses partially covered by insurance – pre-paid expenses are reimbursable for the monthly

payment amount that exceeds the paid insurance portion on the (EOB). Requests for reimbursement should not exceed

expenses associated with services incurred during the current plan year.

No insurance coverage – pre-paid expenses are reimbursable for the component of the expense related to services incurred

during the current enrolled plan year. Requests for subsequent plan years must be resubmitted.

5. Coordination of

Are you or any family members for which you are requesting reimbursement eligible to receive benefits under any medical,

dental, prescription or vision plan other than your primary coverage?

Benefits (COB)

Yes

If yes, you must include a copy of your EOB.

No

If no, you must include an itemized statement.

6. Employee

I certify that all expenses for which reimbursement is claimed from the Flexible Spending Account have been incurred and

have not been reimbursed and are not reimbursable under any other health plan coverage (including a Health Savings

Certification

Account [HSA] that I or my spouse maintain). (I understand that special rules apply in the event that I have both a Health

Savings Account and a Flexible Spending Account, and I have submitted this claim in accordance with the relevant terms of

my benefits plan and the applicable provisions of federal tax law.) I understand that I am required to submit, in addition to this

claim form, an invoice or other statement from health care professional (such as a physician, dentist or pharmacy) or other

independent third party stating that the medical expenses have been incurred and the amount of such expense. I certify that

any claims for orthodontia expenses comply with the rules as stated in paragraph four above. I represent that any individual

(other than the employee or the employee’s spouse) for whom a claim is filed hereunder qualifies as a dependent of the

employee for federal income tax purposes. I further declare that I have not and will not deduct these expenses on my federal,

state or local income tax returns.

►

Sign Here

Employee Signature

Date

Any person who knowingly and with intent to defraud files a statement of claim containing any materially false, incomplete or

misleading information is guilty of a crime.

GC-11-2 (5-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1