SUBMITTING YOUR CLAIM & PREPARING YOUR CLAIM FORM

-

Retain copies for your files. Claim information cannot be returned.

-

Do not highlight the form or enclosed documentation. Highlighting makes scanned and faxed documents difficult to read.

-

Refer to

w

for additional claim tips. Once in Navigator, click on the

C laims & Balances

link and then click on

H U

U H

U

U

C laims

. On the left side of the screen, click on

F orms

. Scroll down to Flexible Spending Account (FSA) and scroll to the Reimbursement

U

U

U

U

section. Click on the link for

H ealth Care and Dependent Care claim submission guidelines

.

U

U

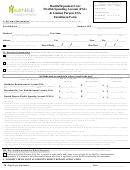

SECTION 1 – Employee Information

FSA Identification Number – As a participant with the FSA, you have been assigned a unique participant number. Your FSA ID Number is a 9

digit number preceded with a “W”. If you do not know your W#, you can locate it from any one of the following sources:

•

E xplanation of Payment (EOP) or Activity Statement

– Paper EOPs and activity statements always display your W#.

U

U

•

A etna Medical ID Card

– If you have Aetna medical coverage, the W# displayed on your ID card is also used for your FSA.

U

U

•

M ember Services

– Call FSA Member Services to inquire about your W#.

U

U

N ote

: If you prefer, you can use your Social Security Number in this field.

U

U

Employee’s Address – Report an address change to your employer. To avoid misdirected claim payments, your employer must notify Aetna of

your new address.

SECTION 2 – Employer Information

FSA Control Number – Your employer has been assigned a unique FSA plan number. If this form does not have that number pre-printed, you

can locate this number from any one of the sources (with the exception of the Aetna Medical ID card) listed above in Section 1.

SECTION 3 – Dependent Care Expense Information

List and separate expenses by individual Qualifying Persons.

N ote

: The following presents the general Internal Revenue Service (IRS) rules.

U

U

CONSULT YOUR PLAN DOCUMENTS FOR SPECIFICS.

A qualifying person is:

1.

Your qualifying child who is your dependent and who was under age 13 when the care was provided.

2.

Your spouse who is physically or mentally unable to care for himself/herself and who lives with you for more than half the year. A

person who is physically or mentally incapable of self-care cannot dress, clean or feed him/herself because of a diagnosed physical or

mental condition.

3.

A person who is physically or mentally unable to care for him/herself and who lives with you for more than half the year, and either:

a.

Is your dependent, or

b.

Would be your dependent except that:

i. He or she receives gross income in excess of the federal exemption amount, or

ii. He or she files a joint return, or

iii. You, or your spouse if filing jointly, can be claimed as a dependent on someone else’s return.

For more information about who is a qualifying person, refer to Publication 503 at

h ttp:///

.

H U

U H

N ote

: A non-custodial parent cannot participate in a Dependent Care FSA, even if the non-custodial parent claims the dependency exemption for

U

U

the qualified person.

Q ualified expenses

must have been incurred to enable you (or, if you are married, you and your spouse) to work or look for work. You

U

U

may also qualify if your spouse is a full-time student or incapable of self-care.

•

In-home services for the care of a qualifying person, including babysitters and nannies.

•

Services of a dependent care center for the care of a qualified per son. A dependent care center is any facility that provides care for

more than six individuals (other than residents), receives payments or grants for providing dependent care services and meets all

requirements of state and local laws.

•

Adult day care.

•

Summer day camp, including a camp that specializes in a particular activity.

•

When provided by the care provider, transportation expenses to and from the care location are eligible for reimbursement.

•

Once the related daycare services have started, daycare deposits, registration fees and agency fees are eligible for reimbursement.

Additional Notes Regarding Requests for Reimbursements:

•

Services are considered incurred when they have been rendered or received, not when you paid for the services.

•

The qualifying person must regularly spend at least 8 hours per day in your home.

•

Unless your caregiver fee is paid on a weekly or longer basis and you are required to pay regardless of attendance, expenses for days

that you do not work (i.e., part-time workers) or are not looking for work or attending school are not eligible for reimbursement.

•

If you receive any reimbursements from your Dependent Care FSA, the IRS requires that you complete Form 2441 and attach it to

your federal income tax return. Form 2441 requires the following dependent care provider information: name, address, SSN/TIN and

amount paid. If you do not provide this information to the IRS you may lose the tax benefits of your FSA. Refer to the IRS website at

h ttp:// /

for forms, instructions, publications and more information.

H U

U H

SECTION 4 – Expenses for Before & After Kindergarten

Tuition for kindergarten or higher level education is not an eligible dependent care expense. Services for before and after-school care qualify for

reimbursement when listed separately.

SECTION 5 – Payments to Certain Dependent Care Providers are Not Reimbursable

Payments made to your spouse, the parent of your qualifying child, your child or step-child under age 19 (even if not your dependent) or a person

whom you claim as a dependent on your tax return are not reimbursable.

SECTION 6 – Employee/Caregiver Certification

Y ou must sign and date this form to avoid claim payment delays.

U

GC-12 (8-10) H

1

1 2

2