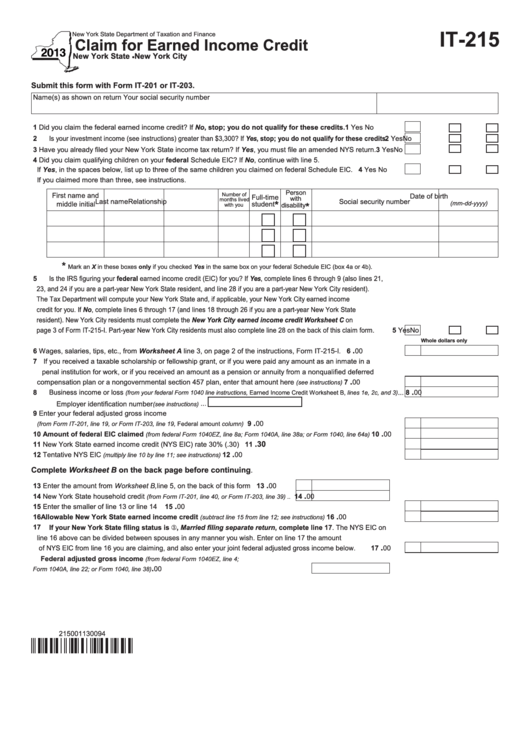

IT-215

New York State Department of Taxation and Finance

Claim for Earned Income Credit

New York State

New York City

•

Submit this form with Form IT-201 or IT-203.

Name(s) as shown on return

Your social security number

1

Did you claim the federal earned income credit? If No, stop; you do not qualify for these credits. .......................

1

Yes

No

2

Is your investment income (see instructions) greater than $3,300? If Yes, stop; you do not qualify for these credits. .......

2

Yes

No

3

Have you already filed your New York State income tax return? If Yes, you must file an amended NYS return. ........

3

Yes

No

4

Did you claim qualifying children on your federal Schedule EIC? If No, continue with line 5.

If Yes, in the spaces below, list up to three of the same children you claimed on federal Schedule EIC. ................

4

Yes

No

If you claimed more than three, see instructions.

Person

First name and

Number of

Date of birth

Full-time

with

months lived

Last name

Relationship

Social security number

*

(mm-dd-yyyy)

middle initial

student

*

disability

with you

*

Mark an X in these boxes only if you checked Yes in the same box on your federal Schedule EIC (box 4a or 4b).

5

Is the IRS figuring your federal earned income credit (EIC) for you? If Yes, complete lines 6 through 9 (also lines 21,

23, and 24 if you are a part-year New York State resident, and line 28 if you are a part-year New York City resident).

The Tax Department will compute your New York State and, if applicable, your New York City earned income

credit for you. If No, complete lines 6 through 17 (and lines 18 through 26 if you are a part-year New York State

resident). New York City residents must complete the New York City earned income credit Worksheet C on

page 3 of Form IT-215-I. Part-year New York City residents must also complete line 28 on the back of this claim form. .....

5

Yes

No

Whole dollars only

.

6

Wages, salaries, tips, etc., from Worksheet A line 3, on page 2 of the instructions, Form IT-215-I. ............................

6

00

7

If you received a taxable scholarship or fellowship grant, or if you were paid any amount as an inmate in a

penal institution for work, or if you received an amount as a pension or annuity from a nonqualified deferred

.

compensation plan or a nongovernmental section 457 plan, enter that amount here

......................

7

00

(see instructions)

.

Business income or loss

8

...

8

00

(from your federal Form 1040 line instructions, Earned Income Credit Worksheet B, lines 1e, 2c, and 3)

Employer identification number

...

(see instructions)

9

Enter your federal adjusted gross income

.

.........................................................................

9

00

(from Form IT-201, line 19, or Form IT-203, line 19, Federal amount column)

.

10

Amount of federal EIC claimed

.............. 10

00

(from federal Form 1040EZ, line 8a; Form 1040A, line 38a; or Form 1040, line 64a)

.

30

11

New York State earned income credit (NYS EIC) rate 30% (.30) ................................................................................. 11

.

12

Tentative NYS EIC

........................................................................................... 12

00

(multiply line 10 by line 11; see instructions)

Complete Worksheet B on the back page before continuing.

.

13

Enter the amount from Worksheet B, line 5, on the back of this form ................... 13

00

.

14

New York State household credit

14

00

(from Form IT-201, line 40, or Form IT-203, line 39) ..

.

15

Enter the smaller of line 13 or line 14 ........................................................................................................................... 15

00

.

16

Allowable New York State earned income credit

.................................... 16

00

(subtract line 15 from line 12; see instructions)

17

If your New York State filing status is , Married filing separate return, complete line 17. The NYS EIC on

line 16 above can be divided between spouses in any manner you wish. Enter on line 17 the amount

.

of NYS EIC from line 16 you are claiming, and also enter your joint federal adjusted gross income below. ................ 17

00

Federal adjusted gross income

(from federal Form 1040EZ, line 4;

.

....................................................................

00

Form 1040A, line 22; or Form 1040, line 38)

215001130094

1

1 2

2