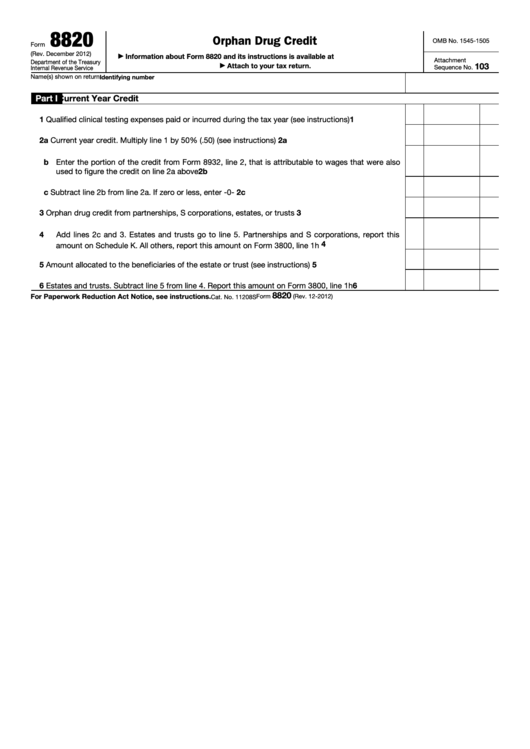

Form 8820 - Orphan Drug Credit

ADVERTISEMENT

8820

Orphan Drug Credit

OMB No. 1545-1505

Form

(Rev. December 2012)

Information about Form 8820 and its instructions is available at

Attachment

Department of the Treasury

103

Attach to your tax return.

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Current Year Credit

1

Qualified clinical testing expenses paid or incurred during the tax year (see instructions) .

.

.

.

1

2a Current year credit. Multiply line 1 by 50% (.50) (see instructions)

.

.

.

.

.

.

.

.

.

.

.

2a

b Enter the portion of the credit from Form 8932, line 2, that is attributable to wages that were also

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

used to figure the credit on line 2a above

2b

c Subtract line 2b from line 2a. If zero or less, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2c

3

Orphan drug credit from partnerships, S corporations, estates, or trusts .

.

.

.

.

.

.

.

.

3

4

Add lines 2c and 3. Estates and trusts go to line 5. Partnerships and S corporations, report this

4

amount on Schedule K. All others, report this amount on Form 3800, line 1h .

.

.

.

.

.

.

.

5

Amount allocated to the beneficiaries of the estate or trust (see instructions) .

.

.

.

.

.

.

.

5

6

Estates and trusts. Subtract line 5 from line 4. Report this amount on Form 3800, line 1h .

.

.

.

6

8820

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2012)

Cat. No. 11208S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2