Attachment To Form 8233

Download a blank fillable Attachment To Form 8233 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Attachment To Form 8233 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

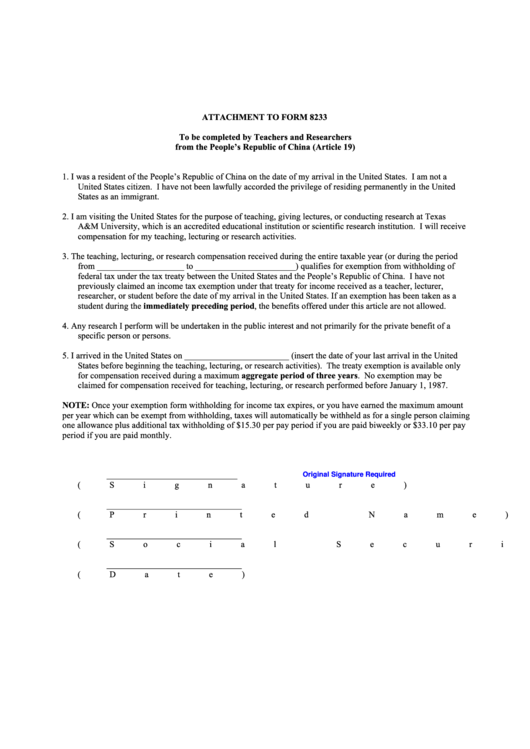

ATTACHMENT TO FORM 8233

To be completed by Teachers and Researchers

from the People’s Republic of China (Article 19)

1. I was a resident of the People’s Republic of China on the date of my arrival in the United States. I am not a

United States citizen. I have not been lawfully accorded the privilege of residing permanently in the United

States as an immigrant.

2. I am visiting the United States for the purpose of teaching, giving lectures, or conducting research at Texas

A&M University, which is an accredited educational institution or scientific research institution. I will receive

compensation for my teaching, lecturing or research activities.

3. The teaching, lecturing, or research compensation received during the entire taxable year (or during the period

from ____________________ to _______________________) qualifies for exemption from withholding of

federal tax under the tax treaty between the United States and the People’s Republic of China. I have not

previously claimed an income tax exemption under that treaty for income received as a teacher, lecturer,

researcher, or student before the date of my arrival in the United States. If an exemption has been taken as a

student during the immediately preceding period, the benefits offered under this article are not allowed.

4. Any research I perform will be undertaken in the public interest and not primarily for the private benefit of a

specific person or persons.

5. I arrived in the United States on ________________________ (insert the date of your last arrival in the United

States before beginning the teaching, lecturing, or research activities). The treaty exemption is available only

for compensation received during a maximum aggregate period of three years. No exemption may be

claimed for compensation received for teaching, lecturing, or research performed before January 1, 1987.

NOTE: Once your exemption form withholding for income tax expires, or you have earned the maximum amount

per year which can be exempt from withholding, taxes will automatically be withheld as for a single person claiming

one allowance plus additional tax withholding of $15.30 per pay period if you are paid biweekly or $33.10 per pay

period if you are paid monthly.

______________________________

Original Signature Required

(Signature)

_______________________________

(Printed Name)

_______________________________

(Social Security Number)

_______________________________

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1