Ftb 3520 C1 - Instructions For Completing The Power Of Attorney Declaration For The Franchise Tax Board

ADVERTISEMENT

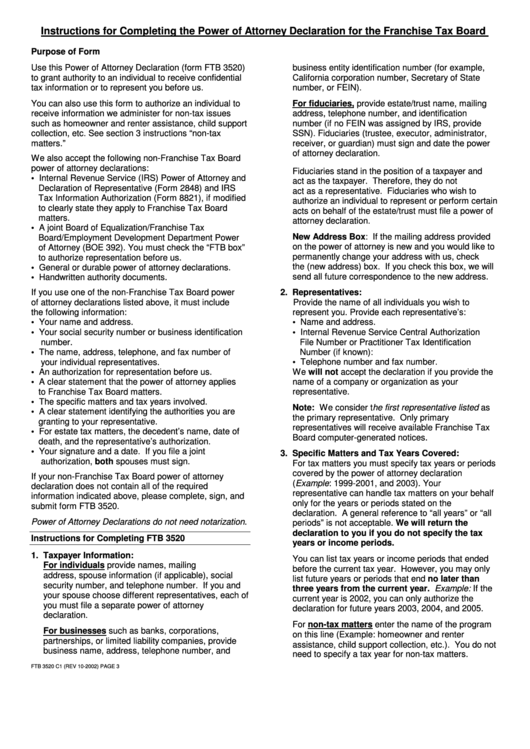

Instructions for Completing the Power of Attorney Declaration for the Franchise Tax Board

Purpose of Form

Use this Power of Attorney Declaration (form FTB 3520)

business entity identification number (for example,

to grant authority to an individual to receive confidential

California corporation number, Secretary of State

tax information or to represent you before us.

number, or FEIN).

You can also use this form to authorize an individual to

For fiduciaries, provide estate/trust name, mailing

receive information we administer for non-tax issues

address, telephone number, and identification

such as homeowner and renter assistance, child support

number (if no FEIN was assigned by IRS, provide

collection, etc. See section 3 instructions “non-tax

SSN). Fiduciaries (trustee, executor, administrator,

matters.”

receiver, or guardian) must sign and date the power

of attorney declaration.

We also accept the following non-Franchise Tax Board

power of attorney declarations:

Fiduciaries stand in the position of a taxpayer and

• Internal Revenue Service (IRS) Power of Attorney and

act as the taxpayer. Therefore, they do not

Declaration of Representative (Form 2848) and IRS

act as a representative. Fiduciaries who wish to

Tax Information Authorization (Form 8821), if modified

authorize an individual to represent or perform certain

to clearly state they apply to Franchise Tax Board

acts on behalf of the estate/trust must file a power of

matters.

attorney declaration.

• A joint Board of Equalization/Franchise Tax

New Address Box: If the mailing address provided

Board/Employment Development Department Power

on the power of attorney is new and you would like to

of Attorney (BOE 392). You must check the “FTB box”

permanently change your address with us, check

to authorize representation before us.

the (new address) box. If you check this box, we will

• General or durable power of attorney declarations.

send all future correspondence to the new address.

• Handwritten authority documents.

If you use one of the non-Franchise Tax Board power

2. Representatives:

of attorney declarations listed above, it must include

Provide the name of all individuals you wish to

the following information:

represent you. Provide each representative’s:

• Your name and address.

• Name and address.

• Your social security number or business identification

• Internal Revenue Service Central Authorization

number.

File Number or Practitioner Tax Identification

• The name, address, telephone, and fax number of

Number (if known):

• Telephone number and fax number.

your individual representatives.

• An authorization for representation before us.

We will not accept the declaration if you provide the

• A clear statement that the power of attorney applies

name of a company or organization as your

to Franchise Tax Board matters.

representative.

• The specific matters and tax years involved.

Note: We consider the first representative listed as

• A clear statement identifying the authorities you are

the primary representative. Only primary

granting to your representative.

representatives will receive available Franchise Tax

• For estate tax matters, the decedent’s name, date of

Board computer-generated notices.

death, and the representative’s authorization.

• Your signature and a date. If you file a joint

3. Specific Matters and Tax Years Covered:

authorization, both spouses must sign.

For tax matters you must specify tax years or periods

covered by the power of attorney declaration

If your non-Franchise Tax Board power of attorney

(Example: 1999-2001, and 2003). Your

declaration does not contain all of the required

representative can handle tax matters on your behalf

information indicated above, please complete, sign, and

only for the years or periods stated on the

submit form FTB 3520.

declaration. A general reference to “all years” or “all

Power of Attorney Declarations do not need notarization.

periods” is not acceptable. We will return the

declaration to you if you do not specify the tax

Instructions for Completing FTB 3520

years or income periods.

1. Taxpayer Information:

You can list tax years or income periods that ended

For individuals provide names, mailing

before the current tax year. However, you may only

address, spouse information (if applicable), social

list future years or periods that end no later than

security number, and telephone number. If you and

three years from the current year. Example: If the

your spouse choose different representatives, each of

current year is 2002, you can only authorize the

you must file a separate power of attorney

declaration for future years 2003, 2004, and 2005.

declaration.

For non-tax matters enter the name of the program

For businesses such as banks, corporations,

on this line (Example: homeowner and renter

partnerships, or limited liability companies, provide

assistance, child support collection, etc.). You do not

business name, address, telephone number, and

need to specify a tax year for non-tax matters.

FTB 3520 C1 (REV 10-2002) PAGE 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2