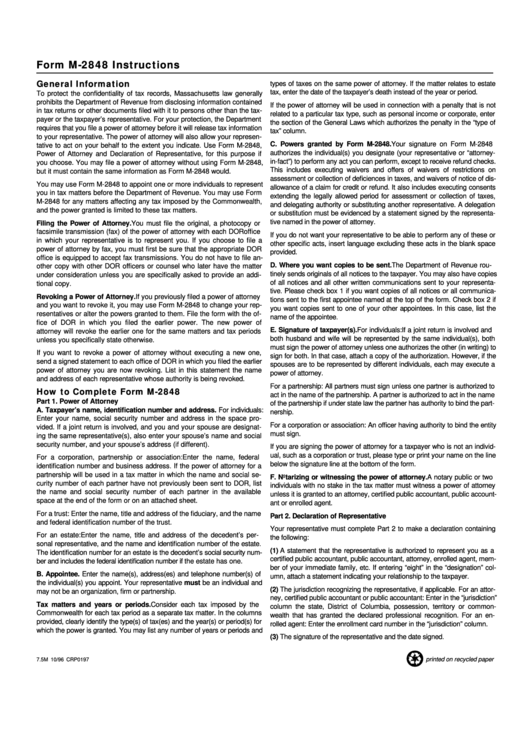

Form M-2848 Instructions

ADVERTISEMENT

Form M-2848 Instructions

General Information

types of taxes on the same power of attorney. If the matter relates to estate

tax, enter the date of the taxpayer’s death instead of the year or period.

To protect the confidentiality of tax records, Massachusetts law generally

prohibits the Department of Revenue from disclosing information contained

If the power of attorney will be used in connection with a penalty that is not

in tax returns or other documents filed with it to persons other than the tax-

related to a particular tax type, such as personal income or corporate, enter

payer or the taxpayer’s representative. For your protection, the Department

the section of the General Laws which authorizes the penalty in the “type of

requires that you file a power of attorney before it will release tax information

tax” column.

to your representative. The power of attorney will also allow your represen-

C. Powers granted by Form M-2848. Your signature on Form M-2848

tative to act on your behalf to the extent you indicate. Use Form M-2848,

authorizes the individual(s) you designate (your representative or “attorney-

Power of Attorney and Declaration of Representative, for this purpose if

in-fact”) to perform any act you can perform, except to receive refund checks.

you choose. You may file a power of attorney without using Form M-2848,

This includes executing waivers and offers of waivers of restrictions on

but it must contain the same information as Form M-2848 would.

assessment or collection of deficiences in taxes, and waivers of notice of dis-

You may use Form M-2848 to appoint one or more individuals to represent

allowance of a claim for credit or refund. It also includes executing consents

you in tax matters before the Department of Revenue. You may use Form

extending the legally allowed period for assessment or collection of taxes,

M-2848 for any matters affecting any tax imposed by the Commonwealth,

and delegating authority or substituting another representative. A delegation

and the power granted is limited to these tax matters.

or substitution must be evidenced by a statement signed by the representa-

tive named in the power of attorney.

Filing the Power of Attorney. You must file the original, a photocopy or

facsimile transmission (fax) of the power of attorney with each DOR office

If you do not want your representative to be able to perform any of these or

in which your representative is to represent you. If you choose to file a

other specific acts, insert language excluding these acts in the blank space

power of attorney by fax, you must first be sure that the appropriate DOR

provided.

office is equipped to accept fax transmissions. You do not have to file an-

D. Where you want copies to be sent. The Department of Revenue rou-

other copy with other DOR officers or counsel who later have the matter

tinely sends originals of all notices to the taxpayer. You may also have copies

under consideration unless you are specifically asked to provide an addi-

of all notices and all other written communications sent to your representa-

tional copy.

tive. Please check box 1 if you want copies of all notices or all communica-

Revoking a Power of Attorney. If you previously filed a power of attorney

tions sent to the first appointee named at the top of the form. Check box 2 if

and you want to revoke it, you may use Form M-2848 to change your rep-

you want copies sent to one of your other appointees. In this case, list the

resentatives or alter the powers granted to them. File the form with the of-

name of the appointee.

fice of DOR in which you filed the earlier power. The new power of

E. Signature of taxpayer(s). For individuals: If a joint return is involved and

attorney will revoke the earlier one for the same matters and tax periods

both husband and wife will be represented by the same individual(s), both

unless you specifically state otherwise.

must sign the power of attorney unless one authorizes the other (in writing) to

If you want to revoke a power of attorney without executing a new one,

sign for both. In that case, attach a copy of the authorization. However, if the

send a signed statement to each office of DOR in which you filed the earlier

spouses are to be represented by different individuals, each may execute a

power of attorney you are now revoking. List in this statement the name

power of attorney.

and address of each representative whose authority is being revoked.

For a partnership: All partners must sign unless one partner is authorized to

How to Complete Form M-2848

act in the name of the partnership. A partner is authorized to act in the name

Part 1. Power of Attorney

of the partnership if under state law the partner has authority to bind the part-

A. Taxpayer’s name, identification number and address. For individuals:

nership.

Enter your name, social security number and address in the space pro-

For a corporation or association: An officer having authority to bind the entity

vided. If a joint return is involved, and you and your spouse are designat-

must sign.

ing the same representative(s), also enter your spouse’s name and social

security number, and your spouse’s address (if different).

If you are signing the power of attorney for a taxpayer who is not an individ-

ual, such as a corporation or trust, please type or print your name on the line

For a corporation, partnership or association: Enter the name, federal

below the signature line at the bottom of the form.

identification number and business address. If the power of attorney for a

partnership will be used in a tax matter in which the name and social se-

F. Notarizing or witnessing the power of attorney. A notary public or two

curity number of each partner have not previously been sent to DOR, list

individuals with no stake in the tax matter must witness a power of attorney

the name and social security number of each partner in the available

unless it is granted to an attorney, certified public accountant, public account-

space at the end of the form or on an attached sheet.

ant or enrolled agent.

For a trust: Enter the name, title and address of the fiduciary, and the name

Part 2. Declaration of Representative

and federal identification number of the trust.

Your representative must complete Part 2 to make a declaration containing

For an estate: Enter the name, title and address of the decedent’s per-

the following:

sonal representative, and the name and identification number of the estate.

(1) A statement that the representative is authorized to represent you as a

The identification number for an estate is the decedent’s social security num-

certified public accountant, public accountant, attorney, enrolled agent, mem-

ber and includes the federal identification number if the estate has one.

ber of your immediate family, etc. If entering “eight” in the “designation” col-

B. Appointee. Enter the name(s), address(es) and telephone number(s) of

umn, attach a statement indicating your relationship to the taxpayer.

the individual(s) you appoint. Your representative must be an individual and

(2) The jurisdiction recognizing the representative, if applicable. For an attor-

may not be an organization, firm or partnership.

ney, certified public accountant or public accountant: Enter in the “jurisdiction”

Tax matters and years or periods. Consider each tax imposed by the

column the state, District of Columbia, possession, territory or common-

Commonwealth for each tax period as a separate tax matter. In the columns

wealth that has granted the declared professional recognition. For an en-

provided, clearly identify the type(s) of tax(es) and the year(s) or period(s) for

rolled agent: Enter the enrollment card number in the “jurisdiction” column.

which the power is granted. You may list any number of years or periods and

(3) The signature of the representative and the date signed.

printed on recycled paper

7.5M 10/96 CRP0197

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1