Form Tc-721 Example - Exemption Certificate

ADVERTISEMENT

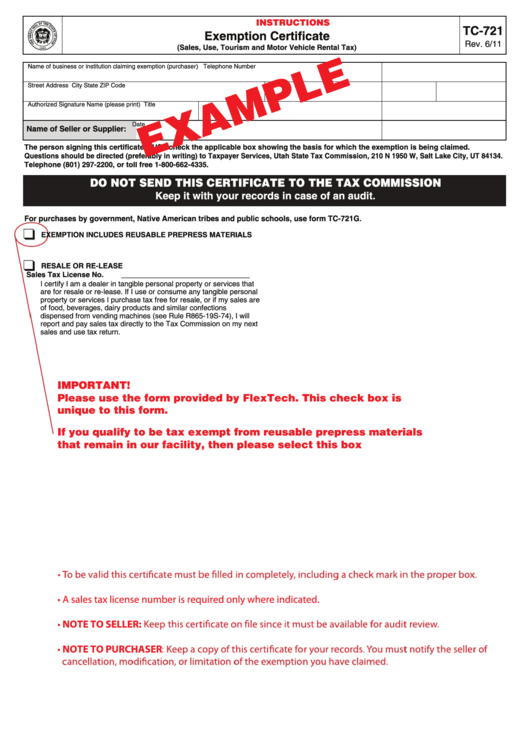

INSTRUCTIONS

TC-721

Exemption Certificate

Rev. 6/11

(Sales, Use, Tourism and Motor Vehicle Rental Tax)

Name of business or institution claiming exemption (purchaser)

Telephone Number

Street Address

City

State

ZIP Code

Authorized Signature

Name (please print)

Title

Date

Name of Seller or Supplier:

The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed.

Questions should be directed (preferably in writing) to Taxpayer Services, Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134.

Telephone (801) 297-2200, or toll free 1-800-662-4335.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

For purchases by government, Native American tribes and public schools, use form TC-721G.

EXEMPTION INCLUDES REUSABLE PREPRESS MATERIALS

RESALE OR RE-LEASE

Sales Tax License No. ___ _ ____ _ __ __ ___

I certify I am a dealer in tangible personal property or services that

are for resale or re-lease. If I use or consume any tangible personal

property or services I purchase tax free for resale, or if my sales are

of food, beverages, dairy products and similar confections

dispensed from vending machines (see Rule R865-19S-74), I will

report and pay sales tax directly to the Tax Commission on my next

sales and use tax return.

IMPORTANT!

Please use the form provided by FlexTech. This check box is

unique to this form.

If you qualify to be tax exempt from reusable prepress materials

that remain in our facility, then please select this box

• A sales tax license number is required only where indicated.

• NOTE TO SELLER:

• NOTE TO PURCHASER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1