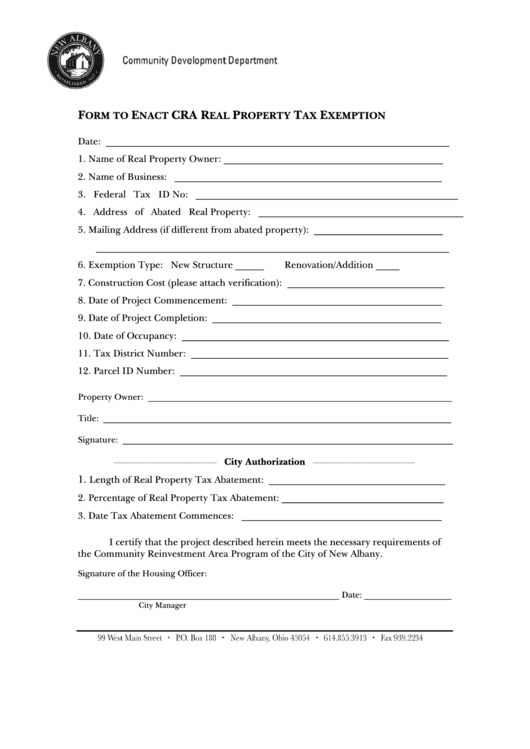

F

E

CRA R

P

T

E

ORM TO

NACT

EAL

ROPERTY

AX

XEMPTION

Date: ________________________________________________________________________

1. Name of Real Property Owner: ______________________________________________

2. Name of Business: ________________________________________________________

3. Federal Tax ID No: _______________________________________________________

4. Address of Abated Real Property: ___________________________________________

5. Mailing Address (if different from abated property): ___________________________

__________________________________________________________________________

6. Exemption Type: New Structure ______

Renovation/Addition _____

7. Construction Cost (please attach verification): _________________________________

8. Date of Project Commencement: ____________________________________________

9. Date of Project Completion: ________________________________________________

10. Date of Occupancy: ________________________________________________________

11. Tax District Number: ______________________________________________________

12. Parcel ID Number: ________________________________________________________

Property Owner: _____________________________________________________________________

Title: _______________________________________________________________________________

Signature: ___________________________________________________________________________

City Authorization

1.

Length of Real Property Tax Abatement: _____________________________________

2. Percentage of Real Property Tax Abatement: __________________________________

3. Date Tax Abatement Commences: __________________________________________

I certify that the project described herein meets the necessary requirements of

the Community Reinvestment Area Program of the City of New Albany.

Signature of the Housing Officer:

____________________________________________________________ Date: ____________________

City Manager

1

1