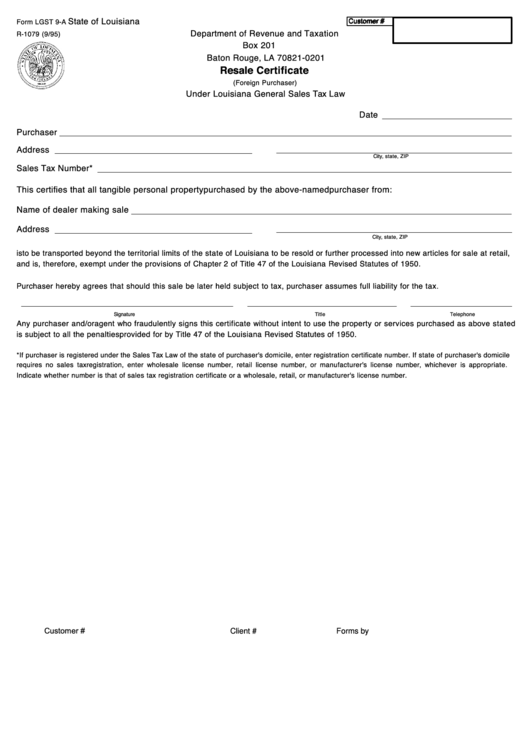

Customer #

State of Louisiana

Customer #

Form LGST 9-A

Department of Revenue and Taxation

R-1079 (9/95)

P.O. Box 201

Baton Rouge, LA 70821-0201

Resale Certificate

(Foreign Purchaser)

Under Louisiana General Sales Tax Law

Date

Purchaser

Address

City, state, ZIP

Sales Tax Number*

This certifies that all tangible personal property purchased by the above-named purchaser from:

Name of dealer making sale

Address

City, state, ZIP

is to be transported beyond the territorial limits of the state of Louisiana to be resold or further processed into new articles for sale at retail,

and is, therefore, exempt under the provisions of Chapter 2 of Title 47 of the Louisiana Revised Statutes of 1950.

Purchaser hereby agrees that should this sale be later held subject to tax, purchaser assumes full liability for the tax.

Signature

Title

Telephone

Any purchaser and/or agent who fraudulently signs this certificate without intent to use the property or services purchased as above stated

is subject to all the penalties provided for by Title 47 of the Louisiana Revised Statutes of 1950.

*If purchaser is registered under the Sales Tax Law of the state of purchaser's domicile, enter registration certificate number. If state of purchaser's domicile

requires no sales tax registration, enter wholesale license number, retail license number, or manufacturer's license number, whichever is appropriate.

Indicate whether number is that of sales tax registration certificate or a wholesale, retail, or manufacturer's license number.

Customer #

Client #

Forms by

1

1