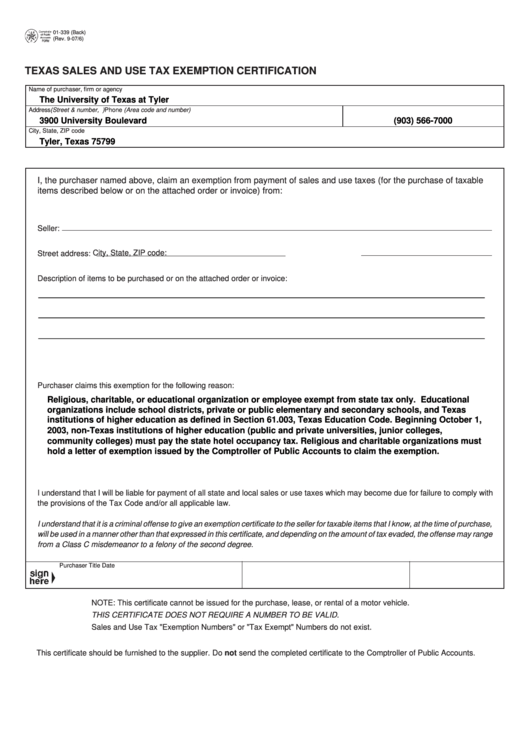

01-339 (Back)

SAVE A COPY

CLEAR SIDE

(Rev. 9-07/6)

TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION

Name of purchaser, firm or agency

The University of Texas at Tyler

Address (Street & number, P.O. Box or Route number)

Phone (Area code and number)

3900 University Boulevard

(903) 566-7000

City, State, ZIP code

Tyler, Texas 75799

I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable

items described below or on the attached order or invoice) from:

Seller:

City, State, ZIP code:

Street address:

Description of items to be purchased or on the attached order or invoice:

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

Purchaser claims this exemption for the following reason:

Religious, charitable, or educational organization or employee exempt from state tax only. Educational

organizations include school districts, private or public elementary and secondary schools, and Texas

institutions of higher education as defined in Section 61.003, Texas Education Code. Beginning October 1,

2003, non-Texas institutions of higher education (public and private universities, junior colleges,

community colleges) must pay the state hotel occupancy tax. Religious and charitable organizations must

hold a letter of exemption issued by the Comptroller of Public Accounts to claim the exemption.

I understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with

the provisions of the Tax Code and/or all applicable law.

I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase,

will be used in a manner other than that expressed in this certificate, and depending on the amount of tax evaded, the offense may range

from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

NOTE: This certificate cannot be issued for the purchase, lease, or rental of a motor vehicle.

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID.

Sales and Use Tax "Exemption Numbers" or "Tax Exempt" Numbers do not exist.

This certificate should be furnished to the supplier. Do not send the completed certificate to the Comptroller of Public Accounts.

1

1